Throughout this year, the market has made it clear that there’s no longer room for excess in Costco Wholesale’s (COST) valuation. The wholesaler’s super-premium multiple appears to have peaked, given its high single-digit sales growth—even though the company’s strong moats support a business model arguably stronger than that of its major retail peers.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Recent comp sales have been volatile, showing some weakness, and the decision to raise membership fees after several years drew mixed reactions from investors. These factors have contributed to COST underperforming the broader market this year and over the past twelve months.

As Costco gears up to report its Fiscal Q4 results, expectations are typically high, given the pressure to overdeliver with such a premium multiple. The last two monthly sales reports, which show a recovery in comparable sales, suggest a strong quarter ahead, supported mainly by steady membership renewal rates. While questions remain about whether this premium is fully justified by the growth story ahead, I see a high likelihood that Costco can sustain its momentum and potentially beat estimates that currently seem somewhat conservative.

As a fairly conservative analyst and investor, I am stoutly Bullish on COST heading into next week’s quarterly earnings update, believing that the recent uptick in comp sales, combined with the company’s enduring competitive advantages, could be enough to get the market to reprice Costco stock more confidently—potentially marking a turning point this year.

The Hidden Power Behind Costco’s Margins

Costco’s thesis essentially boils down to masterfully executing a high-volume, low-margin strategy. The wholesale giant sells products at razor-thin margins—undercutting competitors on price—but makes up for it in sheer volume, which attracts loyal customers and generates a steady cash flow. Layer on the membership model, and the subscription revenue (which is almost pure profit) helps subsidize those slim sales margins, turning the business into a profit machine despite low product-level returns.

Pulling this off at scale requires strict operational discipline: keeping costs down, running lean inventories, executing logistics efficiently, and minimizing promotions.

The results speak for themselves. Over the past five years, Costco has grown revenue at a 10.8% CAGR, reaching $268.7 billion over the last twelve months. Operating profit grew even faster, at a 15.2% CAGR, hitting $10 billion over the same period. That translates to a 3.7% operating margin—technically lower than Walmart (WMT) (4.2%) and Target (TGT) (5.3%).

But here’s the edge: Costco’s membership model is far more resilient and predictable, making the business more profitable in absolute terms. That’s a massive advantage in inflationary or competitive environments. And the proof is in the numbers—of Costco’s 79.6 million paid members, renewal rates hit a staggering 90.2% last quarter, underscoring just how reliable the model really is.

Why Investors Keep Paying Top Dollar for Costco

While Costco has grown revenues at a 10.8% CAGR over the past five years, today’s growth outlook is falling short of double digits. For Fiscal 2025 (ended August), revenues are expected to rise about 8% year-over-year, before slipping slightly to 7.5% in Fiscal 2026 and 7.2% in Fiscal 2027. EPS growth, however, looks stronger—projected at 12.5% in Fiscal 2025 and just over 10% in the following two years.

The big question is whether this level of growth—highly predictable given Costco’s business model—is enough to justify a 54x P/E multiple. If earnings grow in line with expectations over the next two years, that multiple would fall to around 42x. Still, that’s a hefty premium compared to Walmart (WMT), which trades at 39x and is already seen by many as stretched.

In my view, one of the clearest metrics that explains Costco’s premium is its return on invested capital (ROIC), currently at 20.4%. That reflects the power of its high-margin membership model. Moreover, Costco’s net cash balance sheet lowers its cost of capital—around 6.5%—meaning it generates shareholder value well above its financing costs. Compare that to Walmart and Target (TGT), which run at lower ROICs (13% and 11.2%) and carry higher leverage.

It’s worth noting that over the last five years, Costco has typically traded at around 45x P/E—roughly 20% below today’s level—showing just how much of a premium investors are willing to pay for its consistency and capital efficiency.

Looking Ahead to Costco’s Earnings

Costco’s underperformance compared to the broader market this year can be attributed mainly to two factors: stretched valuations and softer comparable sales in May and June, at 6% and 5.8%, respectively. Sentiment improved a bit as comps re-accelerated to 6.4% in July and 6.3% in August. However, the reality is that when a stock trades at such a high multiple, delivering results isn’t enough—it must beat expectations and raise guidance.

That’s why I see Costco heading into its final quarter of fiscal 2025 under heavy pressure to overdeliver. Consensus is calling for Q4 EPS of $5.80—up 12.7% year over year—and revenue of $86.1 billion, up 8%.

The case for a beat rests on the comp sales rebound in July and August, which could suggest that consensus is set conservatively, giving Costco a chance to surprise to the upside and regain momentum.

For context, Walmart reported U.S. comps of ~4.6% last quarter in late August. Given Costco’s stickier membership base, it’s reasonable to expect Costco to at least match—or slightly exceed—8% total sales growth. That’s especially likely if membership renewals remain strong (which I think is a safe bet), inflation continues to drive up nominal sales of essentials, and e-commerce and bulk orders continue to accelerate.

Is COST a Good Stock to Buy Now?

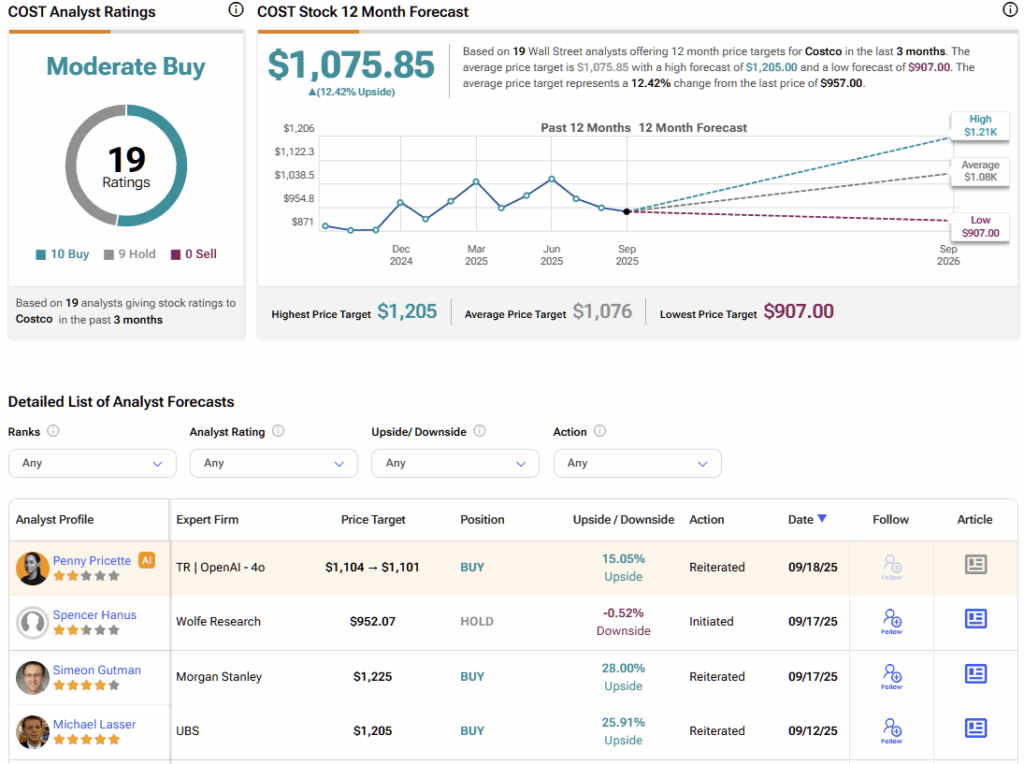

Consensus on COST is mostly bullish, though there’s still room for some skepticism. Of the 19 analysts covering the stock over the past three months, ten rate it a Buy and nine a Hold. The average price target is $1,075.85, implying a potential upside of approximately 12% from the current share price.

Next Earnings Could Revalidate Costco’s Premium

Costco’s business model, with its unique moats, justifies a premium valuation compared to other retailers, mainly because its profits are highly predictable, leaving little room for underperformance. That said, a stretched valuation also means the company needs to overdeliver. The recent recovery in comp sales, along with trends seen in similarly sized retail peers, supports the thesis that Costco is well-positioned to report amiable numbers in the upcoming Fiscal Q4 earnings.

For these reasons, I maintain a Buy rating on COST. I continue to believe the company can regain momentum as long as it continues to deliver results ahead of expectations—which appears likely this quarter. If it does, the stock’s valuation is likely to rise, as it has in past years, even with a steep multiple.