The consumer packaged goods (CPG) space has served up quite a few hidden gems in recent years that have turned into long-term winners, whether it’s Monster Energy (NASDAQ:MNST), Celsius Holdings (NASDAQ:CELH), or BellRing Brands (NYSE:BRBR). Now, Lifeway Foods (NASDAQ:LWAY) could be next in line from the sector to become the market’s next hot growth stock.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

I’m bullish on this tiny, under-the-radar stock based on the differentiated and growing niche it has carved out for itself in the market, its exceptional earnings and revenue growth, and its surprisingly modest valuation.

Additionally, the stock boasts an excellent Smart Score and an average analyst price target that implies upside potential of nearly 60% from current levels.

What Is Lifeway Foods?

You may not yet be familiar with Lifeway, and that’s alright. This is still a small-cap growth stock with a market cap of just under $250 million. Lifeway sells kefir and other probiotic foods. It says that its mission is to “provide the best in probiotic and nutritious foods… improve the health of our customers… (and) leave the world a better place than we found it.”

What Is Kefir, Anyway?

If you aren’t familiar with kefir, it’s a fermented milk drink akin to yogurt that originated in the North Caucasus region of Eurasia. Lifeway describes it as “a tart and tangy cultured milk smoothie that is high in protein, calcium, and vitamin D.”

In addition to its wide variety of kefir products (the company offers an incredible 60 different flavors and varieties), Lifeway also makes probiotic drinks for kids under its ProBugs brand, as well as a cultured soft cheese called Farmer Cheese.

Younger consumers in the U.S. are becoming increasingly health-conscious, so I like the way that Lifeway’s products fit with this lifestyle. Additionally, as GLP-1 weight loss drugs grow more popular, people need to be careful to get enough protein, and Lifeway’s kefirs are chock full of it. An eight-ounce serving contains 11 grams of natural protein.

Lifeway’s kefirs are 99% lactose-free and are “suitable for most people who are lactose intolerant,” a surprisingly large market, as an estimated 30-50 million Americans are lactose intolerant.

I like the fact that Lifeway has carved out a lane for itself where it is the market leader, and it’s likely that these differentiated offerings and their health benefits will continue to drive increased popularity and growth over time. Recent results show that this is happening already.

Record-Setting Results

The company recently reported first-quarter results and posted record revenue of $44.6 million, representing impressive revenue growth of 17.8% year-over-year. This was the fourth straight quarter in which the company set a new record for revenue. Encouragingly, management attributed most of the growth to higher volumes for its drinkable kefirs, indicating that the product category is gaining momentum with consumers.

Lifeway also expanded its gross profit margin from 21.7% last year to 25.8% this year, thanks to higher sales volume of its branded kefir products and some moderation in transportation costs.

While the company missed earnings estimates, it’s important to remember that this is a small-cap stock, and the consensus estimates are only based on a small number of analysts. And while it was a miss, net income still essentially tripled year-over-year (from $830,000 to $2.4 million) so it’s hardly anything to be disappointed about.

Surprisingly Modest Valuation

Because this is a small-cap stock growing revenue quickly, one might expect that the stock would be expensively valued, but it’s not. The company trades at just 19.6 times 2024 consensus earnings estimates. While this isn’t dirt cheap, it’s still cheaper than the broader market. The S&P 500 (SPX) trades at 23.3 times earnings. The stock is even cheaper when looking out to 2025, where it trades at just 13.5 times consensus earnings estimates, a level that will get the attention of even diehard value investors.

Is LWAY Stock a Buy, According to Analysts?

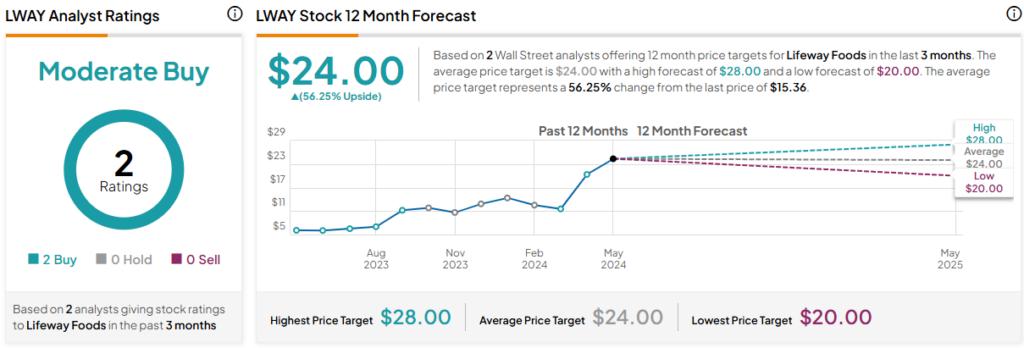

Turning to Wall Street, LWAY earns a Moderate Buy consensus rating based on two Buys, zero Holds, and zero Sell ratings assigned in the past three months. The average LWAY stock price target of $24.00 implies 56.3% upside potential.

This is still a fairly small stock with a market cap of just under $250 million, so it hasn’t garnered a lot of analyst coverage yet, but the potential upside of 56% signaled by the average analyst price target is encouraging.

Furthermore, the higher of the annual price targets ($28.00) implies an even more attractive potential upside of over 82%, while even the lower price target is considerably higher than the stock’s current price of $15.36.

A Smart Choice

In addition to these favorable analyst price targets, Lifeway also features an Outperform-equivalent Smart Score of 8. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from one to 10, based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

Takeout Target?

It’s also worth noting that, given its small market cap and its growth prospects, the company could be an attractive acquisition candidate for a larger consumer staples company looking to gain a foothold in the intriguing kefir space. Danone S.A. (OTC:DANOY), the large-cap French CPG company, has a large stake in the company, so they clearly see the value in Lifeway and could potentially be interested in acquiring more of it at some point.

The Takeaway: A Bright Future Ahead

I’m bullish on Lifeway based on its leadership in a novel, differentiated product category that seems to be resonating with health-conscious consumers and growing in popularity based on recent results. I’m also bullish based on the company’s moderate valuation and its strong revenue growth, which led to record revenue last quarter.

With the promising trajectory that Lifeway is on, I wouldn’t be surprised if a year from now we are discussing it as the next previously unheralded name that emerges as a red-hot consumer staples stock.