Chinese electric vehicle (EV) maker Li Auto (LI) is scheduled to announce its second-quarter results before the market opens on Thursday, August 28. Li Auto has been under pressure due to intense competition in the Chinese EV market. LI lowered its Q2 deliveries outlook due to temporary impacts from sales system upgrades. Wall Street expects Li Auto to report earnings per share (EPS) of $0.23 on revenue of $4.45 billion.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Li Auto’s Q2 deliveries increased by just 2.3% year-over-year to 111,074. The company’s L series models have been witnessing underwhelming demand in the highly competitive Chinese EV market. LI stock has declined by about 19% over the past month and is flat on a year-to-date basis.

Analysts’ Views Ahead of Li Auto’s Q2 Earnings

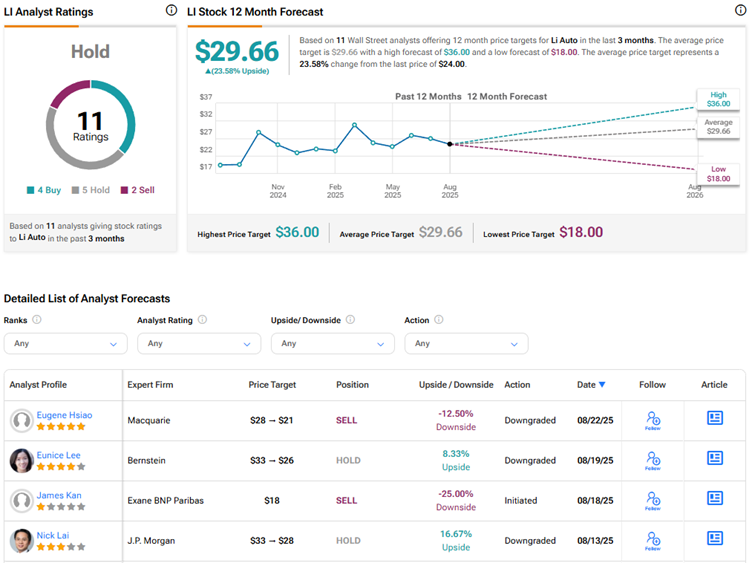

Heading into the Q2 results, three analysts downgraded their ratings for Li Auto stock due to concerns about current headwinds, including weak deliveries.

Macquarie analyst Eugene Hsiao downgraded Li Auto stock to Sell from Hold and lowered the price target to $21 from $28. The 5-star analyst expects Li Auto’s Q2 sales and profit to miss the sell-side consensus. Moreover, Hsiao highlighted that Li Auto’s Q3 volumes are also trending weaker than the Street’s estimates.

Hsiao views a potential successful launch of i6 BEV in September against popular competing battery electric vehicle (BEV) SUVs like Model Y and YU7 as the next catalyst for the stock. The analyst lowered his volume estimates and reduced his FY26E P/E multiple to a 2-year average of 13.0x.

Similarly, JPMorgan analyst Nick Lai downgraded Li Auto stock to Hold from Buy and reduced the price target to $28 from $33. Lai expects the consensus estimates to reflect a slowdown or even a decline in China’s passenger vehicle demand in 2026, as government subsidies expire by the end of this year.

Lai believes that a slowdown may arrive earlier after strong July passenger vehicle growth. Consequently, the analyst lowered his FY25/FY26 volume and earnings estimates by 10% and 20%, respectively, reflecting the fast-changing competitive dynamics in the Chinese EV market.

AI Analyst Is Cautious on LI Stock Ahead of Q2 Print

Interestingly, TipRanks’ AI stock analyst has assigned a Neutral rating to LI stock with a price target of $26, indicating about 8.3% upside potential. TipRanks’ AI analysis highlights Li Auto’s strong financial performance and a positive outlook from the recent earnings call. However, bearish technical indicators and moderate valuation metrics temper the stock’s overall score.

Here’s What Options Traders Anticipate Ahead of Li Auto’s Q2 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about an 8.1% move in either direction in Li Auto stock in reaction to Q2 2025 results.

Is Li Auto Stock a Good Buy?

Given the ongoing challenges, Wall Street has a Hold consensus rating on Li Auto stock based on four Buys, five Holds, and two Sell recommendations. The average LI stock price target of $29.66 indicates 23.6% upside potential from current levels.