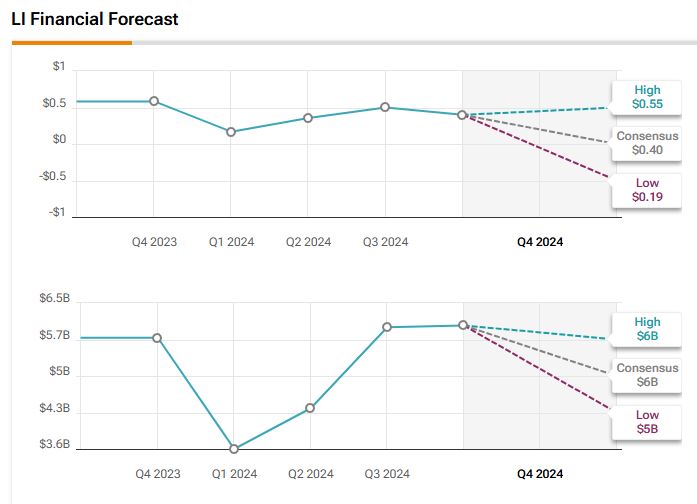

Chinese EV maker Li Auto (LI) is set to release its fourth quarter 2024 results on March 14. LI stock has gained over 24% year-to-date, primarily driven by strong delivery numbers and expansion of its battery electric vehicle (BEV) lineup. Moreover, the company’s focus on advanced driving technology and the upcoming launch of the “i8” model has also fueled optimism. Wall Street analysts expect the company to report earnings of $0.40 per share, representing a 31% decrease year-over-year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Meanwhile, revenues are expected to grow by 4% from the year-ago quarter to $6.02 billion, according to data from the TipRanks Forecast page. It’s worth noting that LI has missed earnings estimates only once in the past nine quarters.

Li Auto is a Chinese automobile manufacturer, offering a range of smart electric vehicles (EVs).

Recent Event Ahead of Q4 Print

Li Auto recently posted solid February deliveries, with 26,263 vehicles delivered in February 2025, marking a 29.7% increase from the previous year. As of February 28, 2025, the company’s total deliveries reached 1,190,062 units. Its focus on family-friendly models with extended-range tech remains a key driver of growth.

Analysts’ Views on LI Ahead of Q4 Results

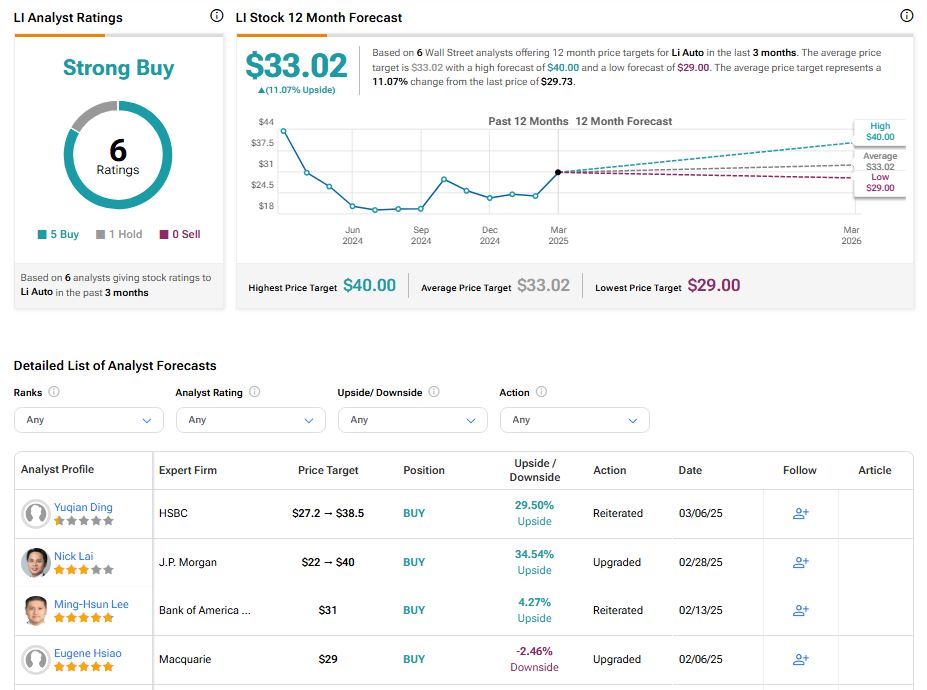

Ahead of LI’s Q2 results, analyst Nick Lai of J.P. Morgan raised the price target on LI stock to $40 from $22 and upgraded the rating to Overweight (equivalent to Buy) from Neutral. Lai expects Li Auto to rebound in 2025 and beyond, viewing the company’s second BEV, the “i8,” as a key growth driver. He also believes that Li Auto’s sales could double to one million units by 2027.

Meanwhile, another analyst, Yuqian Ding of HSBC, also increased the price target on the stock to $38.5 from $27.2 per share, while maintaining a Buy rating.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 9.82% move in either direction.

Is Li Auto a Good Stock to Buy Today?

The stock of LI has a consensus Strong Buy rating among six Wall Street analysts. That rating is based on five Buy, one Hold, and zero Sell recommendations assigned in the last three months. The average LI price target of $33.02 implies 11.07% upside from current levels.