Shares in denim company Levi Strauss (LEVI) were looking smarter today after a leading analyst said the current craze for jeans has…well… legs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Closet Refresh

Tom Nikic of Needham said there was no questioning the recent momentum seen in Levi’s stock. It is up 45% in the year-to-date and a huge 97% in the last six months.

In Q2, the company experienced a 9% organic net revenue growth, with direct-to-consumer sales up 10% and wholesale up 7%. The U.S. business grew 7%, while the international segment increased by 10%, driven largely by a 15% growth in Europe.

Its women’s segment grew 14%, and the tops business grew 16%.

“Investors seem to be highly intrigued by this stock, but the main question mark stems from the durability of the current jeanswear cycle,” said Nikic.

He added that investors are debating whether the strong YTD performance of the denim category is being driven by a one-time “closet refresh.”

For those non-fashionistas that doesn’t mean giving your wardrobe a fresh polish but a picking up or putting down of trends.

Fashion-Leading

In this case Nikic said that the question was whether customers were rocking their denim because it is the end of the “5 years of dominance of sweats, joggers and leggings” or if this heralds a true multi-year fashion shift.

“Our view, which many investors share, is that the current denim cycle is demographically-driven, as Gen Z has become the fashion-leading demographic and they favor wide-leg denim over skinny leggings,” Nikic said. “If this is the case, then we believe there will be durability to this cycle, as the trend makes its way through the rest of the demographic cohorts.”

More indications of whether the denim trend is continuing to swing or starting to fray will come on October 9, when Levi releases its Q3 earnings report.

Despite tariff pressures, Wall Street is bullish on Levi Strauss due to solid denim demand, strong execution, and its focus on direct-to-consumer (DTC) business. Wall Street expects Levi to report earnings per share of $0.31 reflecting a 6.1% year-over-year decline. Meanwhile, revenue is expected to decline 1.1% to $1.5 billion.

Is LEVI a Good Stock to Buy Now?

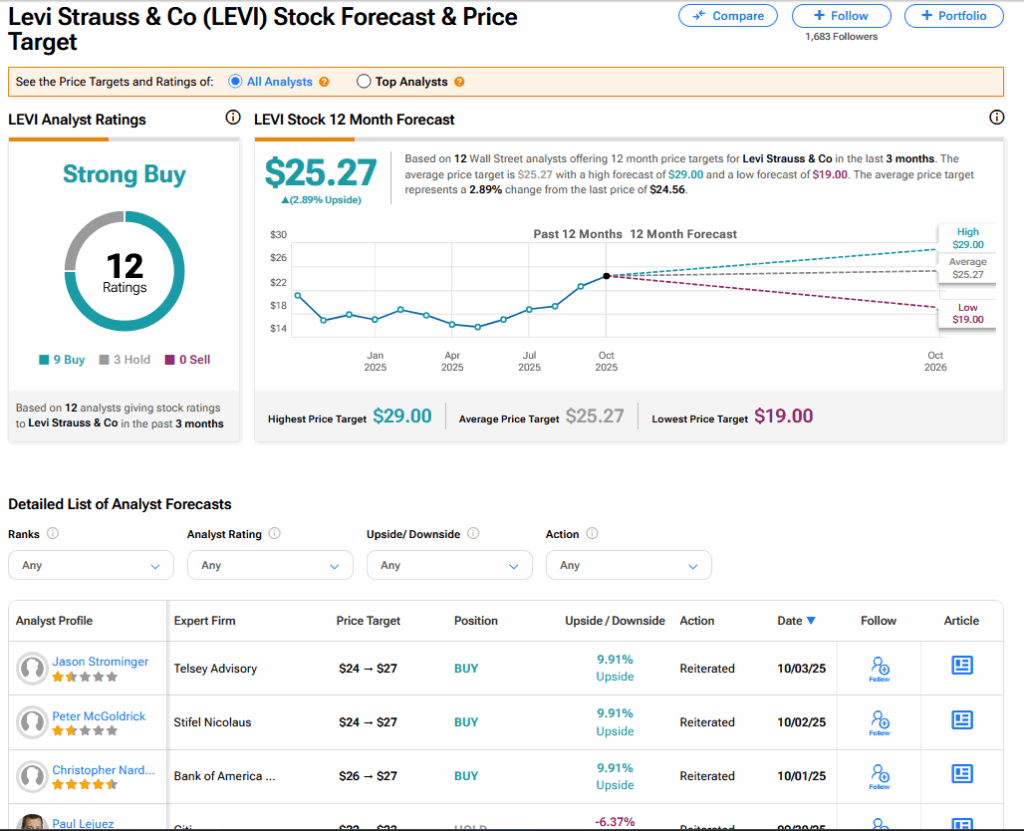

On TipRanks, LEVI has a Strong Buy consensus based on 9 Buy and 3 Hold ratings. Its highest price target is $29. LEVI stock’s consensus price target is $25.27, implying a 2.89% upside.