Amid a renewed interest in denim, Levi Strauss & Co. (LEVI) has encountered difficulties. These include disappointing revenue and declining sales for Dockers. Moreover, there are concerns regarding Levi’s limited success in the Chinese market and the overall diversification of its brand. However, the company has been implementing strategies to enhance profitability by focusing on Direct-to-Consumer (DTC) sales and fostering the growth of the Levi’s brand, helping propel the company’s gross margin to an unprecedented 60%.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

LEVI is looking to continue that trend, with the company streamlining its focus towards high-growth brands, shedding underperforming brands like Dockers, and leveraging the successful Beyond Yoga brand, which reported a 19.3% increase in sales. The stock is up over 22% year-to-date and sports a dividend yield of roughly 2.5%, making it a solid growth at a reasonable price (GARP) option for income-oriented investors.

Levi’s Considering Strategic Options

Levi’s is one of the world’s iconic brands and a global leader in Jeanswear. It offers a wide range of products, from jeans and casual wear to jackets, footwear, and accessories. Its goods are marketed under the Levi’s, Dockers, Signature by Levi Strauss & Co., Denizen, and Beyond Yoga brands.

Levi’s recently announced that it is considering strategic options for the Dockers brand, potentially including a sale. While the review is formally underway, the company has not indicated a specific timeline for its completion, and there is no certainty about the outcome.

Levi’s Recent Financial Results & Outlook

The company recently reported results for Q3. Revenue of $1.52 billion was flat year-over-year and fell short of analysts’ expectations by $30M. The primary brand, Levi’s, experienced a 5% global growth, marking its highest revenue growth in two years, while the direct-to-consumer business also reported double-digit growth. However, the company did note areas of underperformance, such as the declining revenues of the Dockers brand.

Operationally, Levi’s delivered significant margin expansion as the gross margin increased 440 basis points to 60.0% due to lower product costs and favorable channel and brand mix. The adjusted selling, general, and administrative (SG&A) expenses were $735 million. Adjusted net income was $132 million compared to $112 million in Q3 2023. Non-GAAP earnings per share (EPS) of $0.33 beat analysts’ estimates by $0.02.

For the quarter, the company reported a return of approximately $69 million to its shareholders, marking a 45% increase compared to the previous year. This return included dividends of $0.13 per share and $18 million in share repurchases, which effectively retired 1 million shares.

LEVI’s management has offered guidance for fiscal 2024, projecting growth in reported net revenues of around 1%. The company also predicts the adjusted diluted EPS of $1.17 to $1.27.

What Is the Price Target for LEVI Stock?

The stock has been trending upward, climbing roughly 50% over the past year. It trades near the upper middle of its 52-week price range of $12.42 – $24.34 and shows positive price momentum, trading above the 50-day (19.77) and 100-day (19.59) moving averages. With a P/S ratio of 1.3x, the stock appears to be trading at a slight premium to the Apparel Manufacturing industry average of 1.1x.

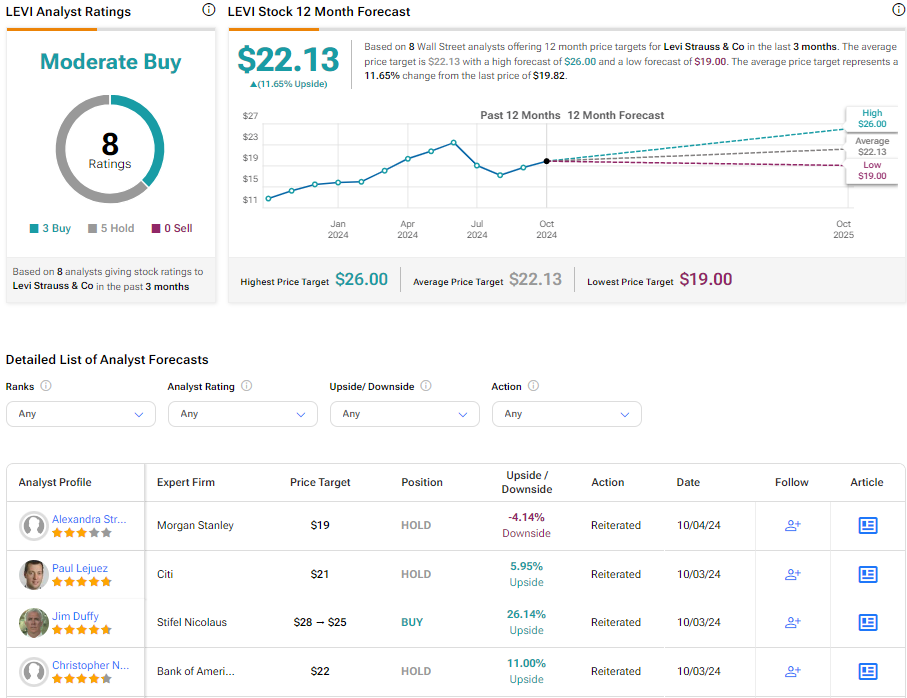

Analysts following the company have taken a cautious stance on the stock. Based on eight analysts’ cumulative recommendations, Levi Strauss & Co. is rated a Moderate Buy. The average price target for LEVI stock is $22.13, representing a potential upside of 11.65% from current levels.

Bottom Line on Levi Strauss

Despite the intersecting challenges of disappointing revenue streams, declining sales for Dockers, and a limited success rate in the Chinese market, Levi’s has been charting a path to enhanced profitability. Its positive momentum and dividends yielding approximately 2.5% have made it a viable GARP investment opportunity in the apparel industry for income-seeking investors.