The average interest rate charged on a 30-year fixed mortgage in the U.S. surged 13-basis points on April 11 to 7.1% as global trade tensions and escalating tariffs continue to upset the bond market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

U.S. mortgage rates have been on a roller coaster over the past week as bond yields spike higher while President Donald Trump engages in a trade war with China, slapping duties of up to 145% on most Chinese imports. The yield on the 10-year Treasury note is again near 4.50%, a concerning level, as investors continue to sell American bonds. Bond prices and yields move in opposite directions.

Analysts are saying that this past week has been the worst one in the bond market since 1980 as volatility wreaks havoc and leads to increased selling of U.S. Treasuries and spiking yields. For homeowners, the rise in yields has led to a significant increase in the interest rates charged on mortgages. That’s bad news for the housing market and home builders such as Lennar (LEN), Toll Brothers (TOL) and NVR (NVR).

Spring Home Sales

The spike in mortgage rates is particularly bad coming as it does at the onset of spring, which is typically the busiest time of the year for the residential housing market. Some analysts say that higher rates will make it impossible for many people to qualify for a mortgage and push many would-be homebuyers to the sidelines. For most consumers, a home is their single largest purchase and investment.

A slump in the housing market could drag on the U.S. economy at a time when many analysts and economists are forecasting a recession. Earlier on April 11, a monthly report on consumer sentiment came in substantially lower than expected as the outlook among U.S. citizens dims in the face of higher prices and a slowing economy due to tariffs.

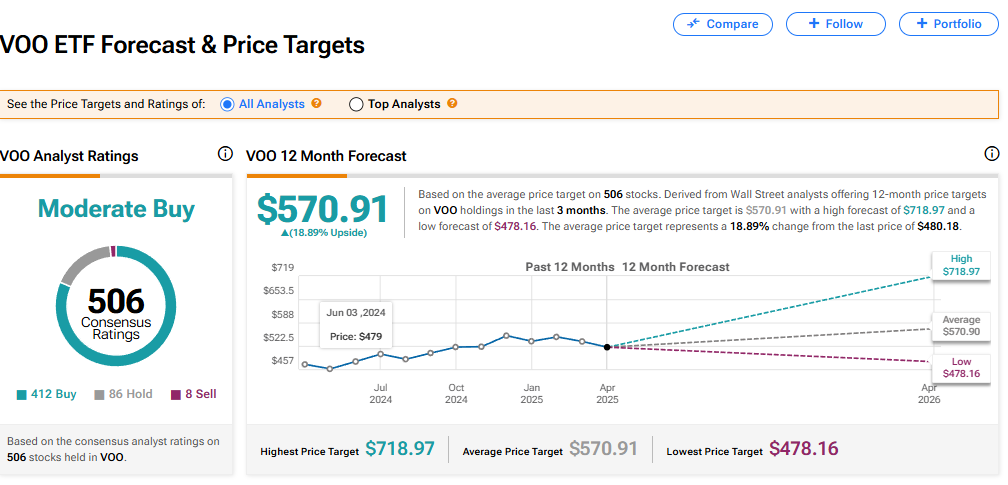

Is the Vanguard S&P 500 ETF a Buy?

The Vanguard S&P 500 ETF (VOO), which tracks the movements of the benchmark U.S. stock index, has a consensus Moderate Buy rating among 506 Wall Street analysts. That rating is based on 412 Buy, 86 Hold, and eight Sell recommendations made in the last three months. The average VOO price target of $570.91 implies 18.89% upside from current levels.