Amazon (NASDAQ:AMZN) will take to the spotlight once the market action comes to a halt today (Thursday, May 1), when the e-commerce giant will dial in its Q1 report.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

While the results are always sure generate plenty of interest given Amazon is one of the world’s leading companies, there’s no doubt this specific quarter comes loaded with additional uncertainties. It’s all about tariffs, of course, with a dash of extra spice thrown in following a recent report that suggested the company might start showing tariff costs on product listings. That resulted in a phone call from Trump to Amazon founder Jeff Bezos. Predictably, Amazon afterwards denied the claim, stating the proposal was “never approved” and that displaying tariff costs “is not going to happen.”

Still, questions linger. Loop Capital’s Rob Sanderson, a 5-star analyst ranked among the top 4% of Wall Street pros, notes it’s unclear how Amazon will navigate the tariff landscape. According to management, though, the likely scenario is straightforward – third-party sellers will simply pass on the higher costs to customers.

That, says Sanderson, will have “some elasticity impact on demand but is GMV accretive on a unit basis.” In any case, while it remains to be seen how the company will manage Chinese supply for 1P sales and “how quickly it passes through price increases,” he thinks it is “only a transitory risk at worst.”

Tariff chaos aside, as for what to expect from the readout, Sanderson believes the consumer environment in Q1 remained sluggish but largely in line with expectations, and that Amazon performed well under the circumstances. The Department of Commerce’s proxy for e-commerce – nonstore retailer sales – grew 4.2% in Q1, with growth accelerating each month and reaching 6.1% in March.

“This bodes well for 1Q results if directionally correct with management providing guidance off the weakest month of the quarter,” the 5-star analyst went on to say. Sanderson also thinks these trends have mostly carried into April and that tariff-related volatility has not yet had a significant impact on consumer spending.

As industry checks across cloud service providers (CSPs) indicate sustained positive momentum despite broader macro uncertainty, Sanderson also anticipates that AWS will deliver “solid results.” The consensus margin estimate of 35.7% – a 190 basis point year-over-year decline – could turn out to be conservative, even when accounting for increased CapEx and a revenue mix shift toward generative AI, which Sanderson assumes comes with lower margins.

This is taking place against a backdrop where the digitization of workflows has become a top priority for execs globally, driven by the rise of generative AI. While mainstream IT use cases for AI are still taking shape, there is an “abundance of demand” from early adopters, and even slower-moving companies are accelerating their cloud migration efforts. As budgets are already funded, Sanderson doesn’t expect significant budget changes unless companies face major spending cuts.

“Google results last week reinforce this view with strong growth at GCP and commentary on capacity shortages and inability to meet current demand,” the analyst noted.

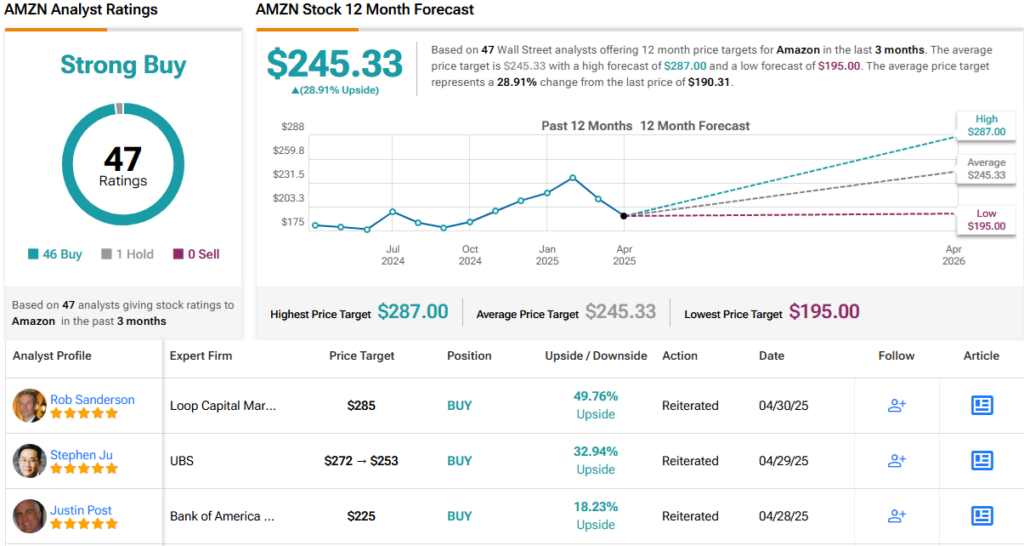

Bottom line, ahead of the print, Sanderson maintained a Buy rating on AMZN shares, while his $285 price target factors in a 12-month gain of ~50%. (To watch Sanderson’s track record, click here)

The rest of the Street offers plenty of support for AMZN too; barring one skeptic, all 45 other recent analyst reviews are positive, naturally making the consensus view here a Strong Buy. The forecast calls for one-year returns of ~29%, considering the average target stands at $245.33. (See AMZN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue