The top 1% pay hedge funds to manage their fortunes aggressively. To maximize profits, hedge fund managers continuously monitor the stock market, often relying on expensive investment tools in their research.

It can be invaluable to know which stocks hedge fund managers are adding to or removing from their portfolios. This is especially interesting during periods of market volatility. TipRanks enables you to do just this.

One way that we provide accountability and transparency in the financial markets is by ranking financial experts according to their performance track records. This includes the biggest hedge fund managers.

With hedge fund SEC filings due this week, this is a great time to find and follow the top 100 hedge fund managers. As with all experts, you can see which stocks they are buying and selling and also find out more about how their hedge fund performs. Here’s how it works.

The Top 100 Hedge Fund Managers

TipRanks only tracks leading hedge funds. It currently tracks the performance of 390 hedge fund managers. At the end of each fiscal quarter, hedge funds managing over $100M are required to submit a 13F form to the SEC listing their current holdings. Based on this information, TipRanks determines how each hedge fund performed compared to other hedge funds and the S&P 500. TipRanks tracks managers by taking 3 factors into consideration:

Portfolio value – total assets under management

Portfolio gain– since 2013

Sharpe ratio – which measures portfolio return, compared to its risk

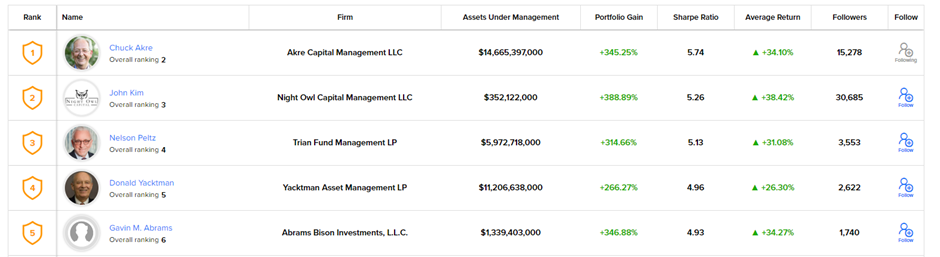

The hedge fund managers section of the expert center introduces you to the top 100 managers. The list includes assets under management, portfolio gain, Sharpe ratio, average return, number of followers, as well as a ‘follow’ button. You can filter the list according to the dollar amount of the assets under management.

Hedge Fund Profile and Transactions

You can find out more about the hedge fund and their transactions when clicking on a manager’s name.

The profile shows you how the dollar value of the hedge fund’s assets under management compares to other hedge funds. You can also see the manager’s average return over three different time periods; since the last filing, over the past 12 months, and three years (annualized).

The profile also presents a breakdown of which sectors the hedge fund covers. You can also see a chart showing the hedge fund’s returns compared to the S&P 500 and the average TipRanks investor.

Essentially, you can see which stocks hedge funds added or removed from their portfolio in the last quarter, as well as the hedge fund’s transaction history per stock.

Hit the follow button to receive notifications about this hedge fund’s transactions.

Now, Give it a Try!

Put the most successful hedge fund managers to work for you! Go to the Hedge Fund Managers section of our Expert Center and follow your favorites. Let us know how you get on!

Twitter | Instagram | Facebook | TikTok | LinkedIn | Support