Investors looking for exposure beyond the U.S. markets might consider China Exchange-Traded Funds (ETFs), which invest in companies based in China. Today, we have leveraged the TipRanks ETF Screener to scan for two such ETFs with at least 30% upside potential: KraneShares CSI China Internet ETF (KWEB) and iShares China Large-CapETF (FXI).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s take a look at what Wall Street thinks about these two ETFs.

Is KWEB a Good Stock to Buy?

The KraneShares CSI China Internet ETF provides exposure to Chinese software and information technology stocks. KWEB has $5.26 billion in assets under management (AUM), with the top 10 holdings contributing 62.07% of the portfolio. Meanwhile, the expense ratio of 0.69% is encouraging.

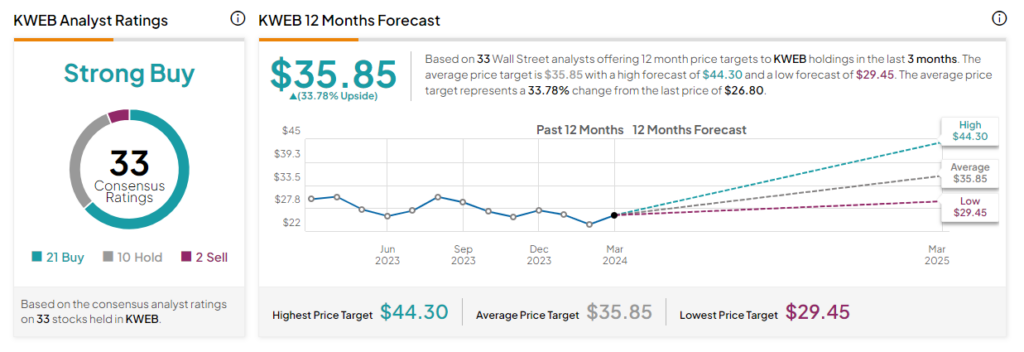

On TipRanks, KWEB has a Strong Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 33 stocks held, 21 have Buys, 10 have Hold ratings, and two have Sell ratings. The analysts’ average price target on the KWEB ETF of $35.85 implies a 33.8% upside potential from the current levels. The KWEB ETF has gained nearly 1% in the past three months.

Is FXI a Good Investment?

The iShares China Large-CapETF invests primarily in Chinese financial and energy stocks. Its portfolio also includes some technology and consumer stocks. FXI has $4.38 billion in AUM, with its top 10 holdings contributing 56.99% of the portfolio. Notably, its expense ratio stands at 0.74%.

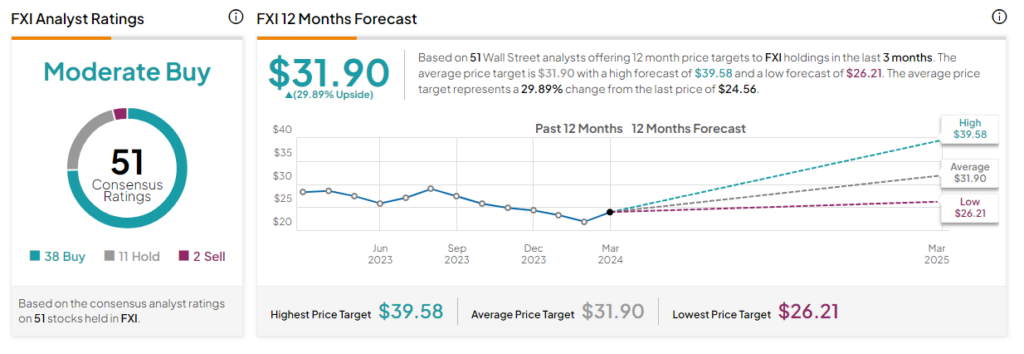

On TipRanks, FXI has a Moderate Buy consensus rating. Of the 51 stocks held, 38 have Buys, 11 have a Hold rating, and two have a Sell rating. The average price target of $31.90 implies a 29.89% upside potential from the current levels. The ETF has gained 5.5% in the past three months.

Concluding Thoughts

Investing in ETFs helps provide diversification and potential growth opportunities. Both FXI and KWEB ETFs seem to be worth considering given their solid upside potential.