Shares of Kohl’s Corp. (KSS) plunged in pre-market trading after the company reported disappointing results. The retailing giant’s earnings plunged by 64.2% year over year to $0.20 per share, below consensus estimates of $0.28 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Furthermore, the company’s revenues declined by 8.7% year-over-year to $3.5 billion in the third quarter. This fell short of Street estimates of $3.6 billion.

KSS’s Management Comments on the Results

Tom Kingsbury, Kohl’s CEO, commented, “Our third-quarter results did not meet our expectations as sales remained soft in our apparel and footwear businesses.” Kingsbury added that although the retailer performed strongly across key growth areas, including “Sephora, home decor, gifting, and impulse,” and also benefited from the opening of Babies “R” Us shops in 200 of its stores, these were unable to offset the declines in its core business.

KSS Updates Outlook

Looking ahead, the company expects its net sales to decline by 7% to 8%, compared to its prior forecast of a 4% to 6% decline. Meanwhile, comparable sales are likely to fall by 6% to 7%. Additionally, the company has projected earnings in the range of $1.20 to $1.50 per share for FY24, down from its previous forecast of $1.75 to $2.25 per share. For reference, analysts had expected the company to report earnings of $1.80 per share.

Kohl’s Will Undergo Management Transition

Kohl’s is preparing for another leadership transition as it names Ashley Buchanan, the current CEO of Michaels, as its next CEO. This marks the retailer’s third CEO change since 2018. The off-mall department store announced that Tom Kingsbury, its current CEO, will step down effective January 15, 2025. Kingsbury initially took on the role on an interim basis in late 2022 before being confirmed as permanent CEO in early 2023.

Kingsbury, however, will not be stepping away entirely. He will remain in an advisory role to Buchanan during the transition and continue to serve on Kohl’s board until his retirement in May. The company plans to reduce the board size by one seat following his departure.

Under Kingsbury’s tenure, the retailer has struggled to regain momentum, with comparable store sales declining for the past 10 consecutive quarters.

Is Kohl’s a Good Stock to Buy?

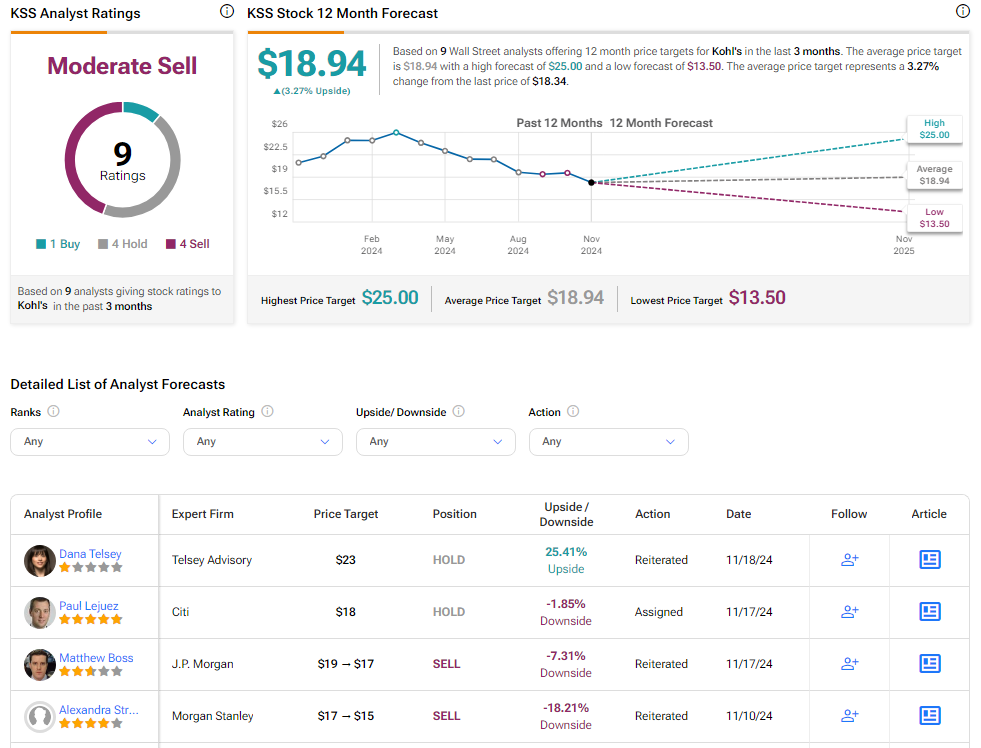

Analysts remain bearish about KSS stock, with a Moderate Sell consensus rating based on one Buy and four Holds and Sell each. Year-to-date, KSS has plunged by more than 25%, and the average KSS price target of $18.94 implies an upside potential of 3.3% from current levels. These analyst ratings are likely to change following KSS’s results today.