Krispy Kreme, Inc. (DNUT) has reported mixed results for the fourth quarter of 2021, as the company’s earnings missed expectations by a cent but revenues topped estimates. Shares of the American doughnut company and coffeehouse chain rallied 8.4% on Tuesday and a further 1.1% in the extended trading session.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Adjusted earnings of $0.08 per share declined 20% on a year-over-year basis and fell short of analysts’ expectations of $0.09 per share. Encouragingly, revenues jumped 13.8% year-over-year to $370.6 million and exceeded consensus estimates of $362.4 million.

The increase in revenues reflected a 13.9% surge in organic revenues, attributable to robust growth in the international segment and strong Delivered Fresh Daily performance in the U.S. and Canada business.

Additionally, adjusted EBITDA increased 14.4% to $47.7 million, while adjusted EBITDA margin improved 10 bps to 12.9%.

Krispy Kreme CEO Mike Tattersfield said, “Looking ahead, we are well-positioned to deliver another year of double-digit revenue growth in 2022. Our performance will be led by the expansion of our omni-channel model, as we continue to significantly expand our points of access. We will continue our transformation to the more profitable and capital efficient hub and spoke model in the U.S. and Canada, which will allow us to grow our most loved sweet treat brand.”

Outlook

For FY2022, the company forecasts revenues to grow 11% to 13% between $1.53 and $1.56 billion. Organic revenue is projected to grow 10% to 12%, compared to FY2021.

Further, the company forecasts adjusted EBITDA growth of 12% to 16% and adjusted net income growth of 18% to 24%. Notably, adjusted earnings per share is anticipated to be in the range of $0.38 to $0.41 per share.

In the long term, the company expects to achieve organic revenue growth of 9% to 11%. Additionally, the company predicts adjusted EBITDA growth between 12% and 14%, along with adjusted net income growth of 18% to 22%.

Stock Rating

Consensus among analysts is a Moderate Buy based on 3 Buys and 1 Sell. The average Krispy Kreme price target of $19.25 implies 29.3% upside potential to current levels.

Negative Sentiment

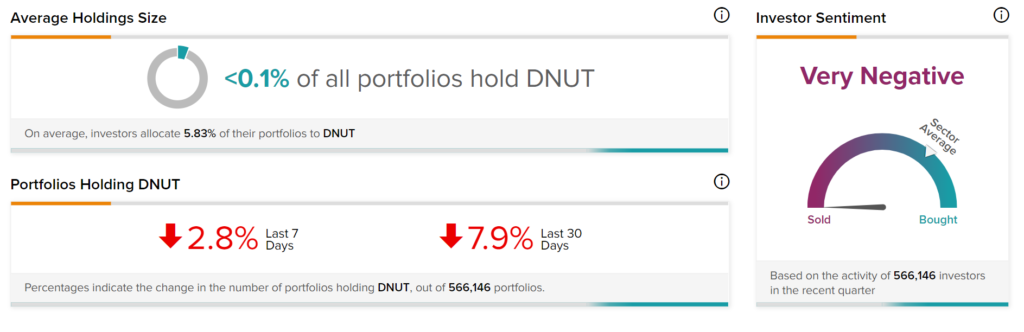

TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on Krispy Kreme, with 7.9% of investors decreasing their exposure to DNUT stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

FDA Lifts Clinical Hold on Ocugen’s New Drug Application for COVAXIN; Shares Gain 15.6%

APA Reports Record Revenue in Q4; Shares Pop

Home Depot Posts Strong Q4 Results; Shares Gain Pre-Market