In the wake of a challenging year for trucking industry, depicted by declining freight shipments, there are glimmers of revival with increasing pricing elements and container volumes. Knight-Swift Transportation (KNX) is poised to capitalize on these favorable market shifts and escalate its profitability in the coming years. The company’s recent acquisition of the less-than-truckload (LTL) carrier Dependable Highway Express (DHE) is a promising development and a strategic move that underscores the company’s future plans.

This marks the third such addition to the firm. With this strategic expansion of its LTL operation, Knight-Swift is on the verge of breaking into the industry’s top-10 carriers, underpinning its ambitious blueprint for a national network. The stock is up over 9% over the past month and trades at a discount to industry peers, making it an attractive option for investors looking for exposure to the trucking industry.

Knight-Swift’s Ambitious Growth Strategy

Knight-Swift Transportation offers shipping and transportation services spanning truckload transportation, less-than-truckload transportation, logistics, and business services.

The company has acquired the operating assets of the regional less-than-truckload (LTL) division of Dependable Highway Express (DHE) for an undisclosed amount. The acquisition is part of Knight-Swift’s plans to expand its LTL business nationwide, particularly in Southwest markets like California, Arizona, and Nevada, raising its coverage of the U.S. population from 55% to 70%. The deal is expected to increase KNX’s LTL terminals and door counts by around 10%. DHE, a strong Southwest competitor, had generated around $122 million in operating revenue over the last year with a 10% operating margin.

This marks the company’s third acquisition in the Less Than Truckload (LTL) market as a part of its aggressive expansion strategy. Its 2021 acquisitions included AAA Cooper Transportation for $1.35 billion and Midwest Motor Express for $150 million. Over the past three years, the company has added or leased 56 terminals, with 25 secured from the bankrupt Yellow Corp.

This has propelled Knight-Swift’s annual LTL revenue stream to over $1 billion, placing it close to being in the top-10 carriers list. Knight-Swift intends to expand, with plans to open 38 more terminals in 2024. However, the Northeast remains a significant gap in its coverage, so further M&A is likely.

Knight-Swift’s Recent Financial Results

The company’s recently announced Q2 2024 performance and showcased mixed outcomes. Revenue of $1.85 billion surpassed the analysts’ estimates of $1.83 billion and marked a substantial rise of 18.9% year-over-year. However, the operating income saw a significant downturn, plunging 32.5% from $94,030 in Q2 2023 to $63,460 in Q2 2024. In addition, the net income attributable to Knight-Swift declined steeply by 67.9% year-on-year. Lastly, the company undershot the estimated earnings per share (EPS) expectations, with EPS of $0.24 underperforming the consensus forecast of $0.27.

As of the quarter’s end, the company reported a balance of $1.1 billion in unrestricted cash and liquidity, alongside a debt of $2.5 billion. It generated $310.7 million in operating cash flows, paid down finances such as lease liabilities ($39.7 million) and operating lease liabilities ($91.4 million), and made net repayments on the 2021 Revolver and accounts receivable securitization totaling $21.6 million.

Free cash flow reached $52.1 million, with the board of directors declaring a quarterly cash dividend of $0.16 per share, equating to a dividend yield of 1.24%.

Management has also issued guidance for the the full year, with Adjusted EPS for Q3 and Q4 of 2024 anticipated to range between $0.31 – $0.35 and $0.32 – $0.36, respectively.

What Is the Price Target for KNX Stock?

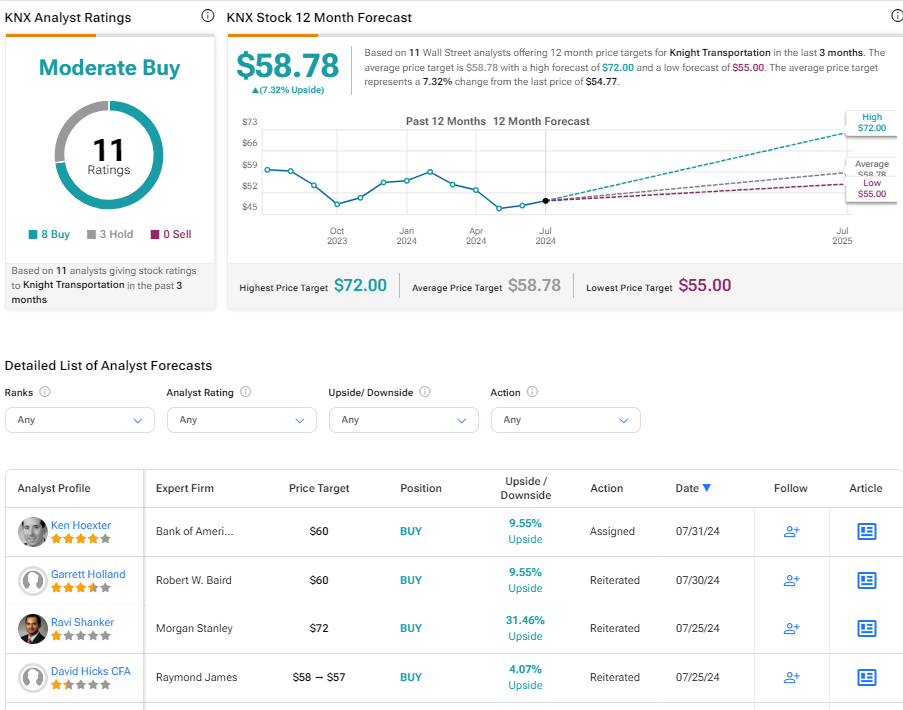

After a disappointing year, the stock has rebounded, climbing over 16% in the past three months. It trades near the middle of its 52-week price range of $45.55 – $60.99 and shows positive price momentum, trading above its 20-day (50.15) and 50-day (49.63) moving averages. With an EV to EBITDA of 10.15, the stock trades at a discount to peers in the Trucking industry, where the average EV/EBITDA is 14.96.

Analysts following the company have been constructive on the stock. For instance, BofA analyst Ken Hoexter reiterated a Buy rating on the shares and raised the price target to $60.

Knight Transportation is rated a Moderate Buy overall, based on the recommendations and price targets issued by 11 analysts. The average price target for KNX stock is $58.78, representing a potential 7.32% upside from current levels.

Final Analysis on KNX

Knight-Swift Transportation is strategically poised to enhance its footprint and profitability in the future, boosting its appeal to potential investors. The company’s recent acquisition of Dependable Highway Express (DHE) is a significant step towards expanding its less-than-truckload operation, potentially propelling it into the top 10 industry carriers.

Despite a mixed Q2 2024 performance, the company has a robust cash and liquidity balance, hinted at promising future earnings, and paid notable dividends. Trading at a discount compared to its peers, KNX is positioned as an attractive investment in the trucking industry.