CarMax (KMX) stock plummeted Thursday after the used car retailer published its Fiscal Q4 2025 earnings report. Earnings per share of 58 cents weighed down KMX stock as it missed Wall Street’s 66 cents per share estimate. That’s despite an 81.2% year-over-year increase compared to 32 cents per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

CarMax’s revenue of $6 billion also failed to impress KMX investors when compared to the analyst estimate of $6.04 billion. However, traders will note that revenue was up 6.6% year-over-year from $5.63 billion. This was fueled by a 6.2% increase in used vehicle sales in CarMax’s Fiscal Q4 2025 compared to the year prior.

CarMax investors weren’t pleased with the company’s latest earnings data, which sent shares 7.01% lower in pre-market trading today. That builds on a 2.08% decrease year-to-date.

What’s Next for CarMax?

CarMax also upset investors with its future plans. The company removed the timeframe for several of its growth goals due to “the potential impact of broader macro factors.” It also expects Fiscal 2026 capital expenditures to reach $575 million. The company attributes this to land purchases that were pushed from Fiscal 2025 to Fiscal 2026.

CarMax’s poor performance this quarter also calls into question its future. The used car market is resilient to tariffs as its main revenue, used car sales, aren’t affected by tariffs. However, it looks like other macro pressures could keep CarMax from capitalizing on that potential.

Is KMX Stock a Buy, Sell, or Hold?

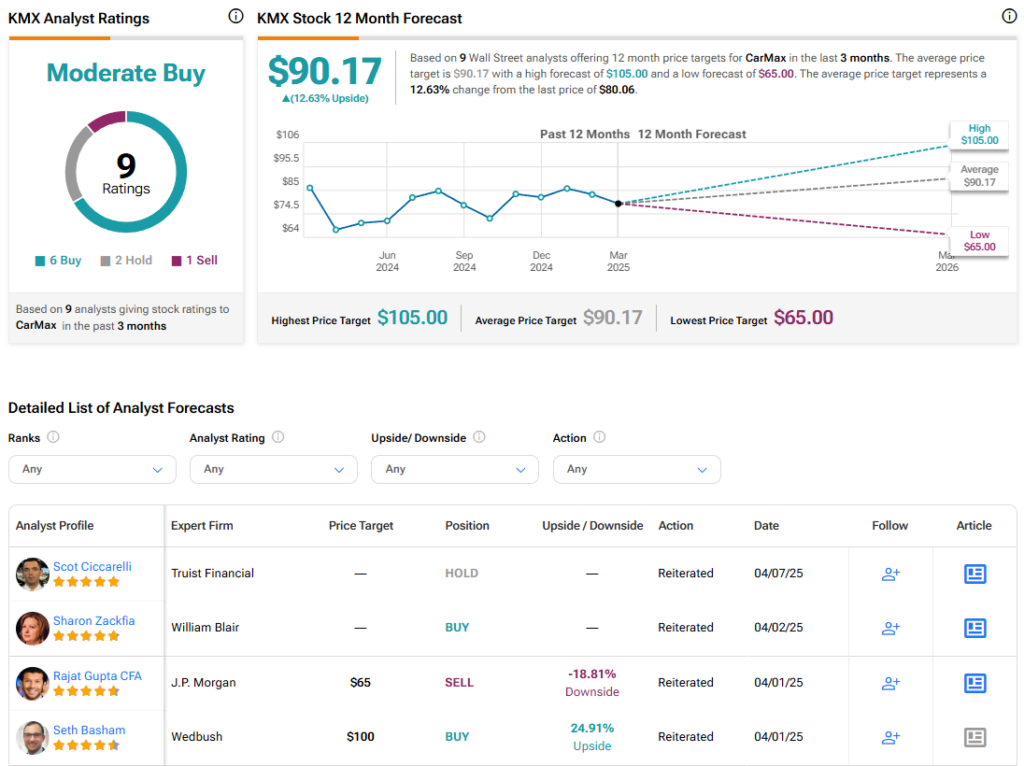

Turning to Wall Street, the analysts’ consensus estimate for CarMax is Moderate Buy based on five Buy, two Hold, and one Sell ratings over the last three months. With that comes an average price target of $90.17, representing a potential 12.63% upside. These ratings and price targets will likely change as analysts update their coverage after today’s earnings.