The stock of Swedish online lender Klarna (KLAR) jumped 30% in its debut on the New York Stock Exchange (NYSE).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company’s shares began trading on Sept. 10 at $52, which was 30% above the final initial public offering (IPO) price of $40. The company, known for its buy now, pay later products, raised $1.37 billion from the stock offering and is now valued at $15 billion. Klarna is the largest IPO of 2025 so far.

Klarna’s IPO will test Wall Street’s interest in the direction of its financial technology business. The company has in recent months talked up its moves into banking, debit cards, and deposit accounts in the U.S. as it positions itself more as a digital bank than a buy now, pay later concern.

Milestones

“To me, it really just is a milestone,” Klarna’s CEO, Sebastian Siemiatkowski, said in a media interview about the IPO. “It’s a little bit like a wedding. You prepare so much and you plan for it and it’s a big party. But in the end, marriage goes on.”

Klarna says it signed 700,000 debit card customers in the U.S. so far this year and has five million people on a waiting list seeking access to its cards. Klarna competes against rival fintech and buy now, pay later companies Affirm (AFRM) and Block (SQ), among others.

Upcoming IPOs

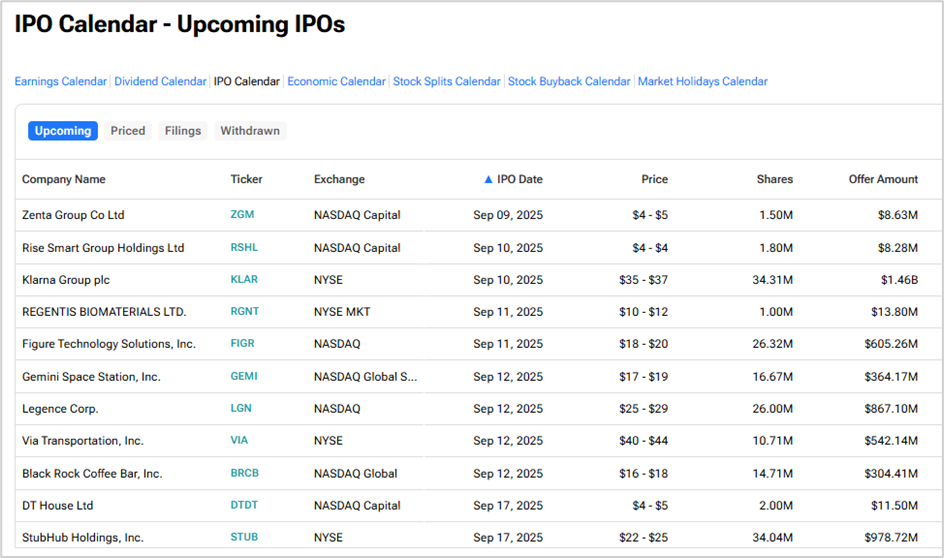

TipRanks has a list of initial public offerings in its IPO calendar. Other upcoming stock issuance can be found in the chart below.