Swedish fintech company Klarna is set to make its stock market debut on the New York Stock Exchange (NYSE) today under the ticker symbol “KLAR.” The underwriters have priced its initial public offering (IPO) at $40 per share, higher than the expected range of $35 to $37 per share. Klarna aims to raise approximately $1.37 billion through this offering, valuing the company at about $15.1 billion.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

The company is offering 34.3 million shares in the IPO, representing around 9% of the total 378 million shares outstanding after the offering. Of the total proceeds, about $1.17 billion will go to existing shareholders who are selling a portion of their holdings, while only $200 million will go to Klarna itself. The lead underwriters for the IPO are JPMorgan Chase (JPM) and Goldman Sachs (GS).

Why Is Klarna Eyeing the U.S. Market?

Klarna is one of Europe’s largest buy now, pay later (BNPL) players, and the U.S. has become its second-largest market. In America, Affirm Holdings (AFRM) has the largest market share, while Klarna will also compete with Block’s (XYZ) Afterpay service and PayPal’s (PYPL) BNPL offerings.

The BNPL model is chipping away at traditional banks’ consumer lending business as shoppers prefer the flexibility of installment plans. Klarna earns revenue by charging merchants fees on each transaction and by collecting interest and late fees on longer-term financing. Klarna also partners with major U.S. retailers, including Macy’s (M) and Walmart (WMT).

One of Klarna’s most popular products is its “pay-in-4” plan, which allows customers to split their purchases into four equal, interest-free installments over six weeks. Klarna also offers long-term BNPL plans with interest. However, the company has ventured into other products lately, including credit and debit cards, and holds a banking license in Europe.

Financial Performance and IPO Outlook

Klarna had planned a U.S. listing in March but postponed amid geopolitical tensions tied to tariff concerns. The company is moving forward now as market conditions stabilize and investor demand for new listings remains strong. Other high-profile IPOs this year include stablecoin issuer Circle Internet (CRCL), design software maker Figma (FIG), and crypto exchange Bullish (BLSH), all of which saw strong debuts.

In August, Klarna announced that its second-quarter revenue jumped 20% year-over-year to $823 million, while losses widened from $18 million in Q2FY24 to $53 million. It remains to be seen if Klarna can attract the same enthusiasm from American investors. With a current valuation of about $15 billion, Klarna represents the largest U.S. IPO of the year so far.

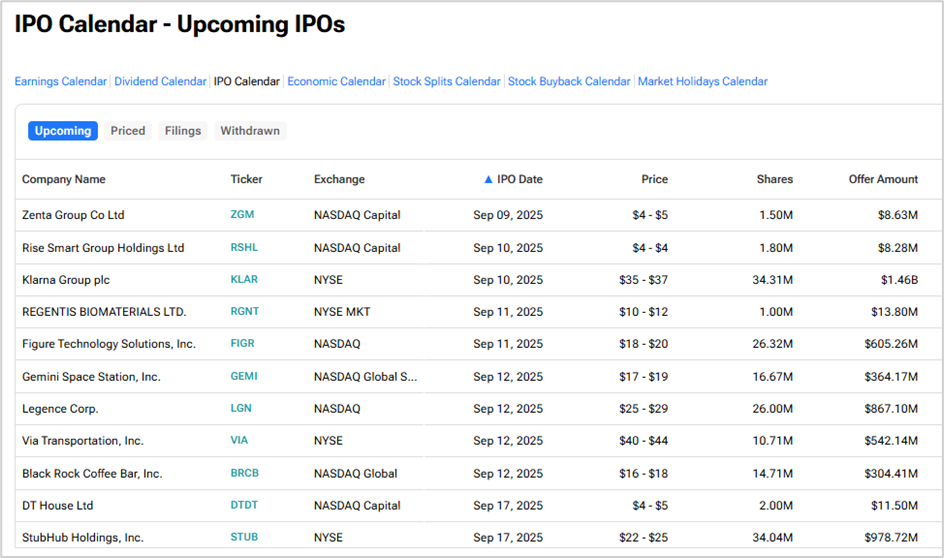

What Other IPOs Are on the Way?

We have compiled a list of IPO filings on our TipRanks IPO calendar.