Cathie Wood’s ARK Invest ETFs (exchange-traded funds) made several notable portfolio moves on Friday, October 10, showing a stronger focus on fintech and tech stocks. The largest buy came from the ARK Fintech Innovation ETF (ARKF), which purchased 1,221,200 shares of LY Corp. (TSE:4689) worth about $3.75 million. LY Corp., a Japan-based digital and fintech firm formed through the merger of Line and Yahoo Japan, continues to attract ARK’s attention as it expands its digital services across Asia.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Meanwhile, ARKF also bought 76,418 shares of Klarna Group (KLAR) valued at around $3.15 million. Klarna, the Swedish payments firm known for its “buy now, pay later” model, has seen improving demand and a sharp rebound in value. The company listed on the Nasdaq on September 10, adding to investor interest this month.

Also, ARKQ bought 10,558 shares of Pony.ai (PONY) worth nearly $235,000, showing ARK’s steady interest in self-driving technology and new innovation names.

Wood Trims Stakes in Palantir, Roblox, and Shopify

On the sell side, ARK reduced several high-growth holdings. Futu Holdings (FUTU), a Hong Kong-based trading platform, saw 6,868 shares sold for about $1.2 million, while Palantir Technologies (PLTR), a U.S. data analytics firm, lost 4,064 shares worth around $754,000.

The gaming platform Roblox (RBLX) was also trimmed, with 9,114 shares sold for over $1.15 million. Meanwhile, Shopify (SHOP), the Canadian e-commerce platform, saw a combined sale of 18,367 shares across the ARK Next Generation Internet ETF (ARKW) and the ARKF, totaling about $3 million.

At the same time, ARKK sold 3,202 shares of Brera Holdings (SLMT), a digital assets firm, for about $60,000, extending a week-long reduction in the stock. Brera, which formerly traded under the ticker BREA, changed its symbol to SLMT on October 3, 2025.

Wall Street’s Take on KLAR, PLTR, RBLX, and SHOP

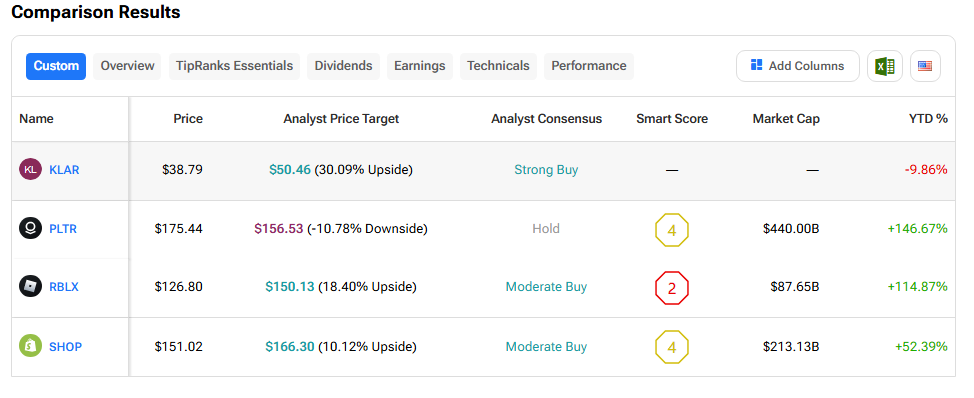

Using the TipRanks Stock Comparison Tool, Klarna leads with a Strong Buy rating and an average KLAR price target of $50.46, implying a potential 30.1% upside from current levels. Meanwhile, Palantir holds a Hold consensus rating, suggesting a 10.8% downside from the current levels.

At the same time, Roblox carries a Moderate Buy rating and a price target of $150.13, indicating an 18.4% upside, while Shopify also earns a Moderate Buy with a target of $166.30, reflecting a 10.1% upside.