Shares in KKR (KKR) lacked fizz today despite reports that it was in pole position to take Japanese herbal health tonic manufacturer Yomeishu Seizo private.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

KKR Has First Negotiation Rights

According to a Bloomberg news report private equity giant KKR has first negotiation rights for Yomeishu Seizo and is planning to finalize the terms such as the purchase price and launch a tender offer in January 2026.

The report, according to sources, revealed that two auctions have been held already, with several funds, such as KKR, making bids for the Japanese group.

The tender offer depends on whether the terms will be finalized with Yomeishu’s largest shareholder, Yuzawa KK, according to the report.

Yomeishu’s market value is about ¥79 billion ($506 million), according to Bloomberg-compiled data. KKR plans to take over all the shares.

KKR, which will be hoping the deal will boost its ailing share price, did not comment on the report.

Herbal Future Looks Bright

Yomeishu, which is listed on the Tokyo Stock Exchange, produces and sells herbal liqueurs and pharmaceutical products in Japan, Hong Kong, Malaysia, Singapore, and Taiwan. It offers Yomeishu, an herbal liqueur; ginger, ginseng, honey, and medicinal liqueur; fruit and herbs liqueur; Kanomori and Kanoshizuku gin; and craft gin cocktail products. The company also provides Yomeishu cough drops.

In October it revised its financial forecasts for the fiscal year ending March 31, 2026, citing lower than expected domestic sales and visitor numbers at its facility. The company anticipated a decrease in net sales and profits due to the impact of rising prices on consumer behavior.

The Japanese herbal medicine market however looks healthy. It generated a revenue of $5,618.6 million in 2024 and is expected to reach $21,528.7 million by 2030. The country’s ageing population and consumer demand for natural remedies for their ills is expected to be a key driver of sales.

Japanese firms are becoming increasingly attractive to overseas buyers and investors given the large focus in recent years on improving corporate governance and boosting shareholder returns. A rise in more activist investors is also putting pressure on boards to do deals.

In addition, a weak yen has also created a favorable environment for dealmaking, particularly for private equity groups.

Earlier this year KKR sealed a $2.31 billion deal to buy Japanese medical, agricultural, and construction product maker Topcon.

Is KKR a Good Stock to Buy Now?

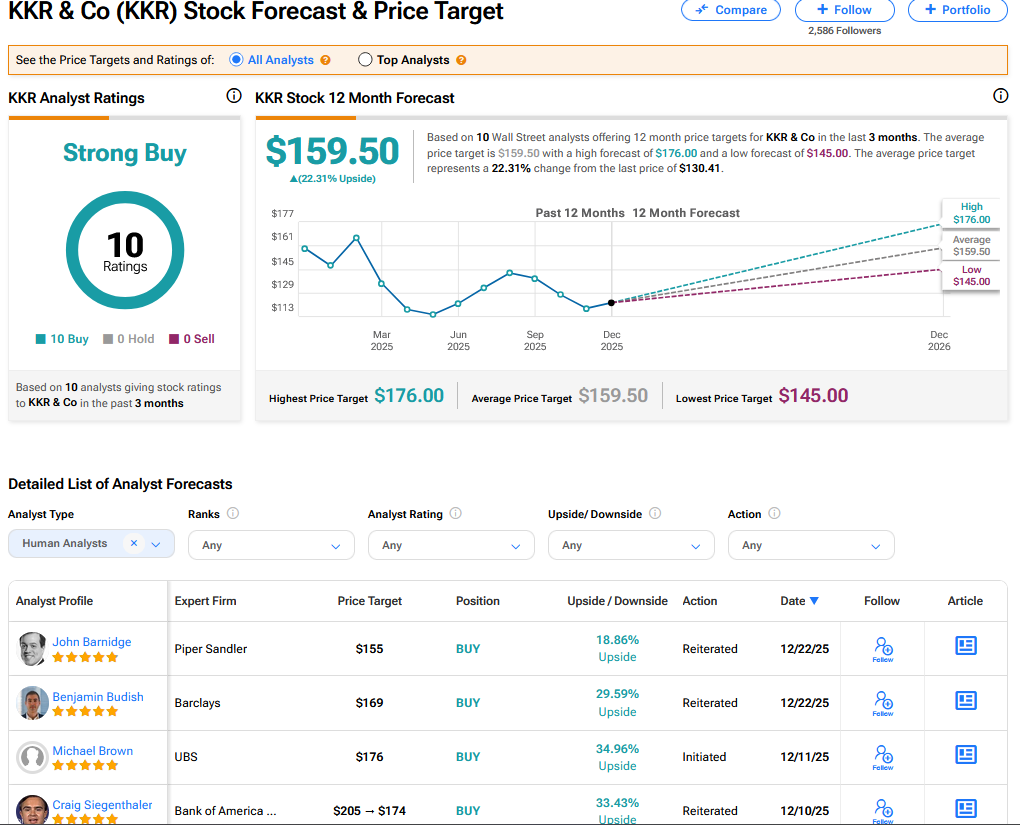

On TipRanks, KKR has a Strong Buy consensus based on 10 Buy ratings. Its highest price target is $176. KKR stock’s consensus price target is $159.50, implying a 22.31% upside.

See more KKR analyst ratings