Kimberly-Clark (NYSE:KMB) shares slumped nearly 5% in the early session today after the personal care and consumer tissue products provider delivered a dismal fourth-quarter performance. Revenue of $4.97 billion came in essentially flat year-over-year. The figure missed expectations by $20 million. Further, EPS of $1.51 lagged estimates by $0.03.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, organic sales increased by 3%. Its gross margin expanded by 210 basis points to 34.9% on the back of favorable net revenue realization and productivity gains. However, the company’s Q4 performance saw an impact from adverse foreign currency movement and the divestment of its tissue and K-C Professional business in Brazil. Additionally, KMB’s operating profit declined by 6% to $670 million owing to currency impacts that included net monetary position losses in hyperinflationary markets.

Looking ahead to Fiscal Year 2024, Kimberly-Clark expects organic net sales growth of a low-to-mid single-digit percentage. Adjusted EPS for the year is seen rising by a high single-digit percentage in constant currency terms. The company expects currency translation to negatively impact its reported EPS growth by 400 basis points.

Separately, Kimberly-Clark has increased its quarterly dividend by 3.4% to $1.22 per share. The KMB dividend is payable on April 2 to investors of record on March 8.

Is KMB a Good Stock to Buy?

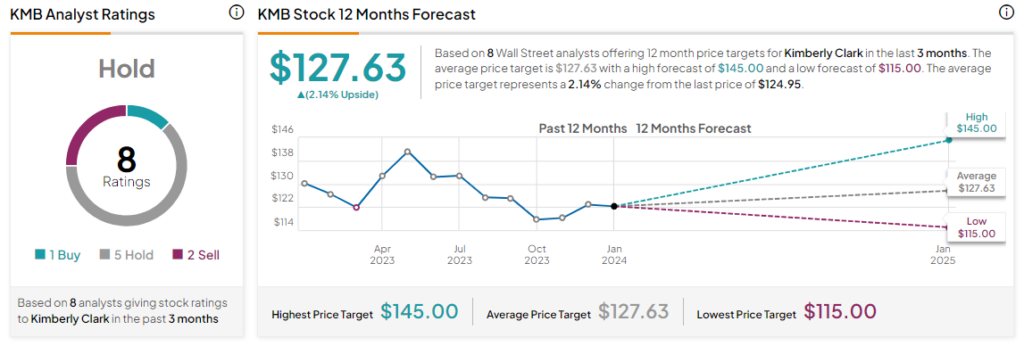

Overall, the Street has a Hold consensus rating on Kimberly-Clark, and the average KMB price target of $127.63 points to a modest 2.1% potential upside in the stock. That’s after a nearly 9% decline in the company’s share price over the past six months.

Read full Disclosure