Keysight Technologies (NYSE:KEYS) shares are trending higher today after the technology solutions provider delivered a better-than-anticipated performance for the fourth quarter. Despite a 9% year-over-year decline, revenue of $1.31 billion came in ahead of expectations by about $10 million. EPS of $1.99 also outpaced estimates by $0.12.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Despite a challenging macro environment, Keysight is witnessing robust customer engagement. During the quarter, the company generated $378 million in cash flow from operations and a steady $340 million in free cash flow.

At the same time, its revenue from the Communications Solutions Group (CSG) segment declined by 10% to $891 million, primarily due to weakness in commercial solutions. Further, revenue in the Electronic Industrial Solutions Group (EISG) segment dropped by 7% to $420 million owing to lower customer spending in semiconductor and manufacturing.

Looking ahead to the first quarter of Fiscal year 2024, Keysight expects revenue to be in the range of $1.235 billion and $1.255 billion. EPS for the quarter is anticipated to hover between $1.53 and $1.59.

What Is the Price Forecast for KEYS Stock?

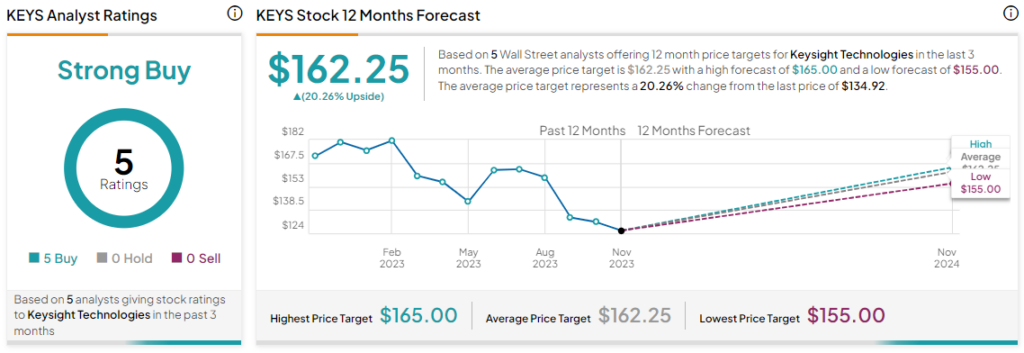

Overall, the Street has a Strong Buy consensus rating on Keysight. The average KEYS price target of $162.25 implies a 20.3% potential upside. That’s on top of a nearly 9% rise in the company’s share price over the past month.

Read full Disclosure