Luxury group Kering (GB:0IIH)(PPRUY) is in advanced talks to buy Tom Ford, the Wall Street Journal reported. Luxury brand Tom Ford is famous for its menswear. The company also designs women’s apparel, cosmetics, handbags, and perfumes.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The report also highlights that Estee Lauder Companies (NYSE:EL) is also in the race to acquire Tom Ford. However, Kering appears to be the front-runner.

This comes when high-end luxury brands are bucking the economic slowdown and delivering solid sales. Kering, for instance, delivered solid top-line growth in Q3. On a comparable basis, its revenues increased 14% year-over-year.

Its CEO, Francois-Henri Pinault, said that the group delivered “sharp top-line growth” that compared favorably to the prior year and the pre-pandemic levels. Notably, Kering’s top line marked a growth of 28% from pre-pandemic levels (Q3 2019).

It’s worth highlighting that all regions, including Asia-Pacific (impacted by COVID-led restrictions in China), recorded growth. Further, its popular brands, including Gucci, Yves Saint Laurent, and Bottega Veneta, reported strong comparable sales.

Given the momentum in its business, let’s see what TipRanks’ data indicates about Kering stock.

Is Kering a Buy or Hold?

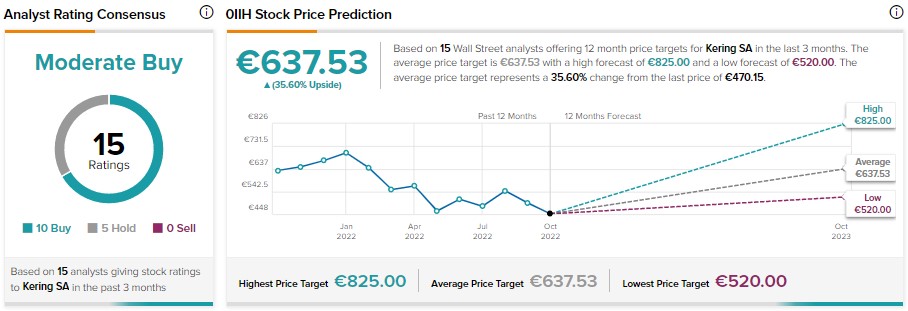

On TipRanks, Kering stock is a Moderate Buy based on 10 Buy and five Hold recommendations. Meanwhile, the average price target of €637.53 implies 35.6% upside potential.

Further, TipRanks’ data shows that hedge funds bought 783.1K Kering stock last quarter. Additionally, 4.9% of investors holding portfolios on TipRanks increased their exposure to Kering stock in the last 30 days. Overall, Kering stock has a Smart Score of six on 10, indicating a Neutral outlook.