U.S.-based consumer health company Kenvue (KVUE), the maker of Tylenol, is drawing fresh investor attention after reports surfaced that the Trump administration plans to link the pain reliever’s active ingredient to autism risk during pregnancy. The potential move could spark market jitters, as any official claim could trigger new rules, lawsuits, or consumer backlash that might hurt Kenvue’s stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, Tylenol is a popular pain reliever that was part of Johnson & Johnson’s (JNJ) portfolio before the company spun off its consumer-health unit as Kenvue in 2023.

Trump Team Targets Tylenol Pregnancy Risks

The Washington Post reports that the Trump administration plans to announce on Monday a possible link between Tylenol use during pregnancy and autism. Meanwhile, federal health officials are expected to caution women against taking Tylenol early in pregnancy unless they have a fever. The same announcement will also spotlight leucovorin, a form of folate, as a potential treatment for autism, according to the report.

At a recent event, Trump described the move as a “very important announcement,” calling it “one of the most important things” his administration will do.

What’s Happening with KVUE Stock?

Amid claims linking Tylenol (acetaminophen) to autism, KVUE stock has been volatile over the past month, dropping about 15%.

Earlier this month, shares fell over 13% to a 52-week low after reports that Health Secretary Robert F. Kennedy Jr. planned to release a report suggesting a connection between Tylenol and autism, as first reported by The Wall Street Journal. Following this, interim CEO Kirk Perry met with Kennedy, requesting that Tylenol be exempted from the report. His intervention provided some relief to the stock.

In response, a Kenvue spokesperson told CNBC that research shows no credible link between acetaminophen and autism. However, investors are closely watching for any official announcement linking the two, as it could trigger more volatility for KVUE stock.

Is Kenvue a Good Stock to Buy?

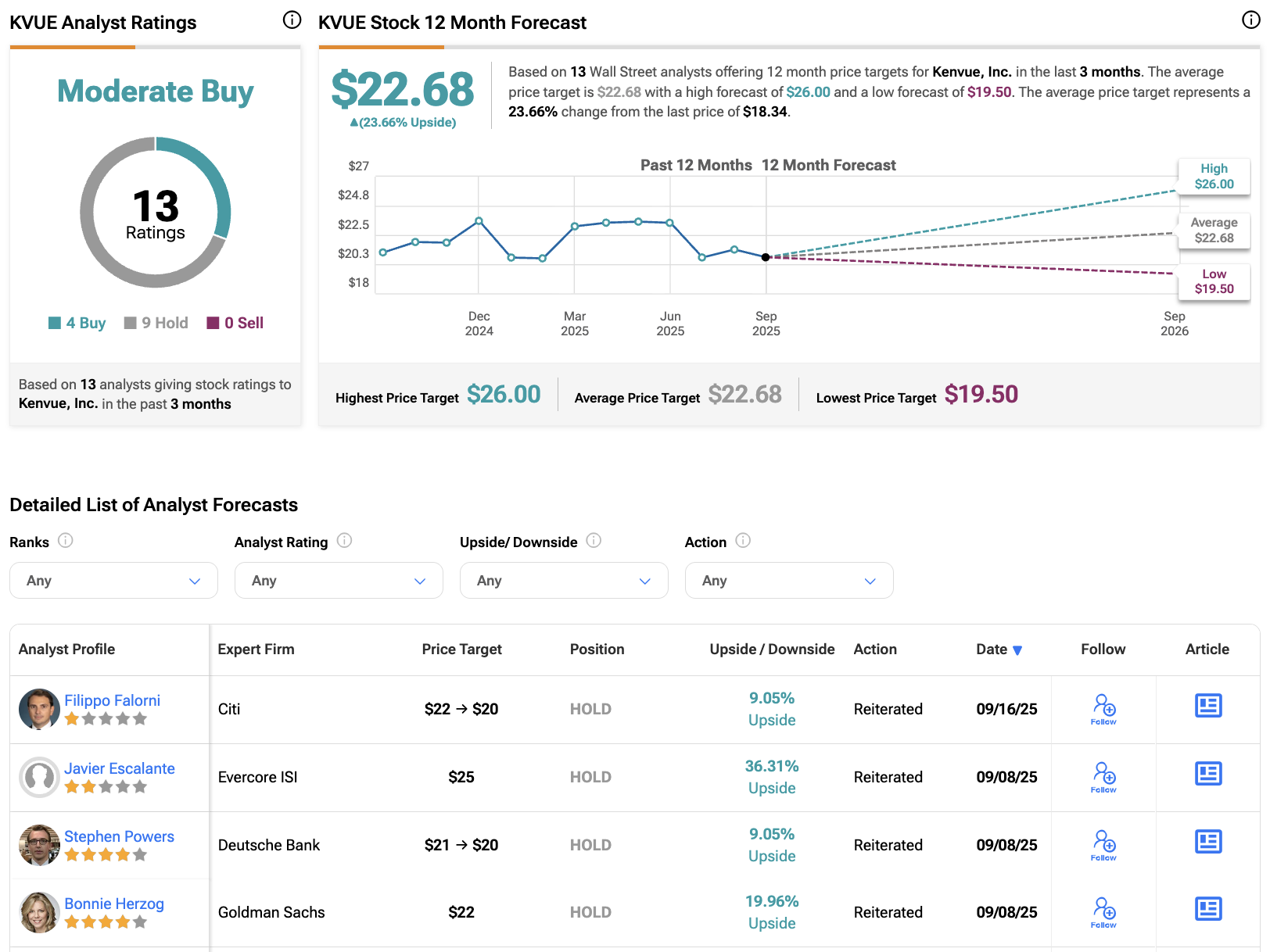

On TipRanks, KVUE stock has received a Moderate Buy consensus rating, with four Buys and nine Holds assigned in the last three months. The average Kenvue stock price target is $22.68, suggesting an upside potential of 23.6% from the current level.