The stock of KB Home (KBH) is down about 3% after the U.S. homebuilder lowered its full-year guidance, saying it expects further weakness in the real estate market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The disappointing outlook overshadowed what was otherwise a strong print from KB Home. The Los Angeles, California-based company announced Fiscal second-quarter earnings per share (EPS) of $1.50, which beat the consensus estimate of $1.47. Revenue for the quarter ended May 31 was $1.53 billion, beating the $1.51 billion expected on Wall Street.

However, both the top and bottom line numbers reported for Fiscal Q2 were lower than a year ago, when the company’s EPS came in at $2.15 and its sales totaled $1.71 billion. KB Home also lowered its full-year Fiscal 2025 guidance, saying it now expects revenue of $6.30 billion to $6.50 billion, down from $6.60 billion to $7 billion previously.

Homebuilding operating income declined to $131.5 million from $188.2 million a year ago, while the company’s homebuilding operating margin fell 9% from 11.1% a year earlier in the latest quarter. Also, housing gross profit fell to 19.3% from 21.1% a year ago, mainly due to price reductions and homebuyer concessions.

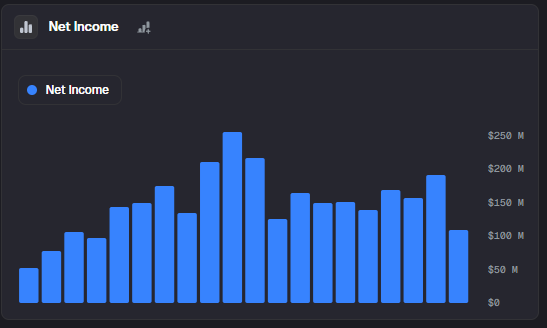

KB Home’s net income. Source: Main Street Data

Stock Buybacks

In the company’s earnings release, KB Home’s CEO Jeffrey Mezger said, “In this environment and given our strong existing land pipeline, we are scaling back our land acquisition and development investments while increasing share repurchases.”

KB Home bought back $200 million worth of common stock at an average price of $54 per share in the just completed quarter. Mezger said the company plans to continue repurchasing shares during the rest of this year.

The average selling price of a KB Home property was $488,700 during the recent quarter, down from $500,700 in the previous quarter amid ongoing softness in the real estate market. Net orders decline 13% year-over-year to 3,460, while net order value fell 21% to $1.61 billion. KBH stock has declined 18% this year.

Is KBH Stock a Buy?

The stock of KB Home has a consensus Hold rating among 14 Wall Street analysts. That rating is based on four Buy, eight Hold, and two Sell recommendations issued in the last three months. The average KBH price target of $66 implies 23.78% upside from current levels. These ratings are likely to change after the company’s financial results.