Kaival Brands Innovations Group (KAVL), the maker of the BIDI Stick, a disposable tobacco vaping device, has seen its stock surge by over 75% in the past week after announcing a merger with Delta Corp Holdings Limited.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The merger, scheduled to be completed in the fourth quarter of 2024, is set to take place at an implied price per share of $2.66, a significant premium to Kaival’s current stock price. It will transform the two companies into a public entity operated by the Delta management team and utilize Delta’s global reach across 16 countries and its asset-light approach to attempt to drive growth in bulk & energy logistics, fuel supply, and commodities markets.

This merger will combine businesses through a holding company structure, with Kaival Brands and Delta each becoming wholly-owned subsidiaries of the new entity, “Pubco.” The completion of the merger is contingent upon specific terms, such as the approval of Kaival Brands’ shareholders and the successful listing of a new holding company’s ordinary shares on Nasdaq.

The fact that the current share price is significantly lower than the merger price indicates that the market is factoring in a real risk that the merger terms may not be fulfilled. Long-term investors may want to revisit this opportunity after a successful merger and leave the gambling to the speculators in the near term.

Kaival’s in the Right Direction

Kaival Brands is a U.S.-based company that sells, markets, and distributes electronic nicotine delivery system (ENDS) products and related components. Its product line includes the Bidi Stick, a disposable ENDS product in different flavors designed explicitly for adult cigarette smokers. Kaival Brands markets its products to non-retail customers via convenience stores and its website.

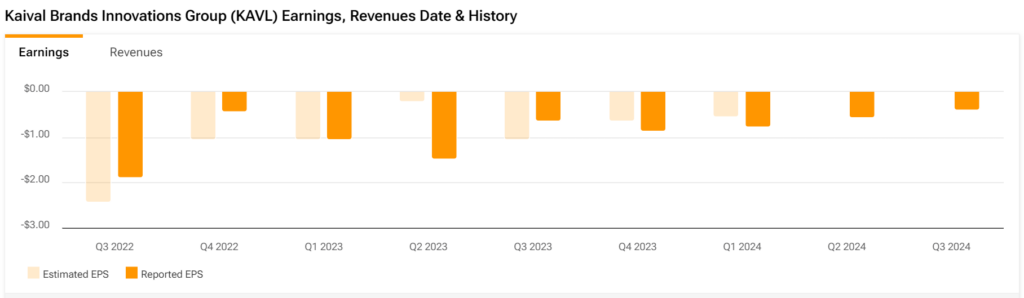

Despite declining revenues, the company’s earnings have been trending in the right direction over the past few quarters. Still, the company has a way to go to reach profitability. A merger that can lift sales without lowering the cost structure could unlock its profit potential.

Delta’s Growing Conglomerate

Delta is a privately held London-based company focusing on logistics, fuel supply, and asset management services. The company primarily facilitates global energy trade, raw materials, intermediate goods, and agricultural products. It maintains offices in 16 countries spanning Europe, the Middle East, Asia, and Africa.

The company operates through its three segments: Bulk Logistics, Energy Logistics, and Asset Management.

Delta has been pursuing growth via merger and acquisition, recently attempting a similar merger agreement with Coffee Holding Co. (JVA), an integrated wholesale coffee roaster and dealer. After an unsuccessful attempt to approve the merger at Coffee Holding’s shareholder meeting, the company terminated the merger, acting as a cautionary tale for the Kaival merger.

Kaival’s Merger in Summary

The proposed merger of Kaival Brands and Delta Corp Holdings presents an intriguing development. Delta’s broad international reach and diverse business capabilities could propel Kaival’s market share growth in the tobacco vaping domain.

While the inherent risks in such a merger must be acknowledged, especially when considering the potential for market volatility and unmet merger terms, it does bring the potential for growth, innovation, and business expansion. As an investor, whether you prefer to watch from the sidelines or engage upfront, keep a keen eye on this space. This story is far from over.