Palantir (NASDAQ:PLTR) is finding itself in a sweet spot as generative AI moves from early-stage adoption to broad operational use. GenAI is being embedded directly into core enterprise workflows – from decision-making and data integration to automation and operational execution – areas where Palantir’s software has already established deep roots across government and commercial customers.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

And the pace of change may be far faster than many expect. Truist analyst Arvind Ramnani argues that GenAI adoption could “compress the market impact” of the last four decades of enterprise technology into just the next five to ten years.

And against this backdrop, Ramnani believes Palantir holds a “unique market position,” one that is “ideally positioned for increased AI adoption by both governments & enterprises.”

The company’s expertise in data integration and security software helps organizations use GenAI on their data, accelerating insight generation and operational efficiency. Palantir’s AI strategy builds on its track record of consolidating and securing customer data to deliver actionable insights, giving it a distinctive advantage in today’s AI environment. The company has embedded AI capabilities into its Gotham (government) and Foundry (commercial) platforms and launched its Artificial Intelligence Platform (AIP) in April 2023. AIP combines Palantir’s data integration and security strengths to allow government and commercial clients to apply large language models (LLMs) to their proprietary data within a secure environment, giving Palantir “ideal positioning as organizations ramp up AI adoption.

Ramnani believes Palantir’s go-to-market strategy outpaces competitors in complex, mission-critical sectors such as defense, healthcare, and manufacturing, where security, governance, and operational execution are essential, by offering a fully integrated stack with built-in security. Once implemented, its platform can enable “cross-functional workflows” more efficiently than piecing together multiple tools, thanks to its end-to-end design. “We view AIP as a differentiated layer with guardrails built in for sensitive contacts – with few others providing this at scale,” Ramnani opined.

Ramnani also thinks the company boasts a “sustainable Rule of 80 profile.” Following a Rule of 114 last quarter (63% year-over-year revenue growth paired with a 51% operating margin), the analyst expects Palantir to sustain a robust margin profile while continuing to see “AI tailwinds” support its top line.

Meanwhile, AI-driven momentum has clearly boosted Palantir’s US business, which grew 77% year-over-year in 3Q25, and Ramnani believes similar tailwinds could gradually extend to its international operations.

Additionally, with free cash flow margins exceeding 40%, Palantir has the potential to meaningfully boost capital returns over time, likely through share repurchases that could help offset stock-based compensation dilution.

Lastly, the stock’s exorbitant valuation often comes up when discussing the investment case here. But although Palantir currently trades above 70x NTM EV/S, Ramnani believes this premium is justified given its “one-of-one financial profile” – consensus forecasts rank it among the top three in growth and the highest margins out of 111 software companies for the next three consecutive years.

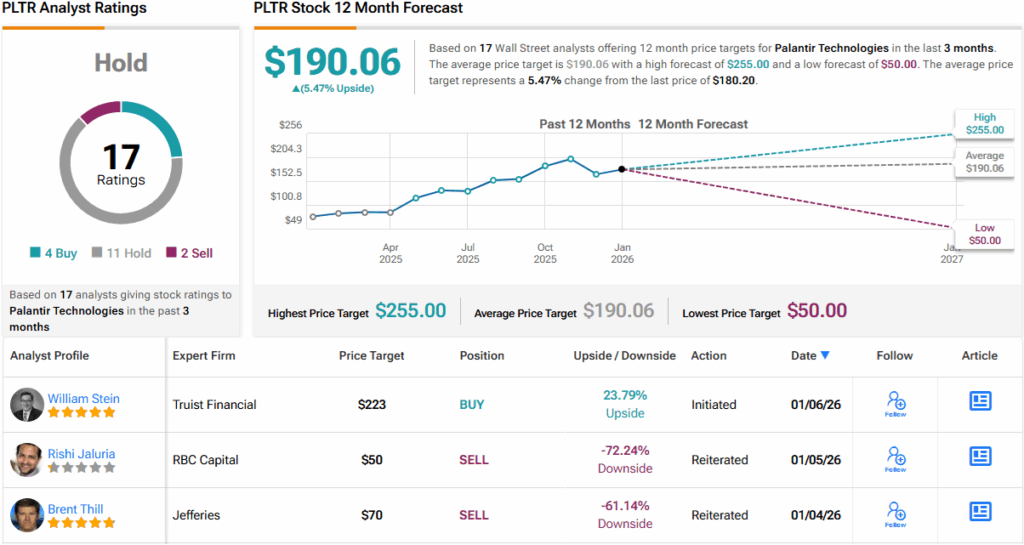

So, add all of the above together, and Ramnani pulls the trigger on PLTR stock, rating it a Buy and assigning a $223 price target, which implies one-year upside of ~24%. (To watch Ramnani’s track record, click here)

The Street’s average target clocks in at a more muted $190.06, implying the shares will gain 5% over the 12-month timeframe. On the rating front, the stock claims a Hold (i.e. Neutral) consensus view based on a mix of 11 Holds, 4 Buys and 2 Sells. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.