JPMorgan Chase (JPM) is taking a major step toward digitizing Wall Street’s most exclusive investments. The bank announced Thursday that it has tokenized a private-equity fund on its in-house blockchain platform, offering digital fund shares to its wealth management clients.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

The move marks JPMorgan’s first real-world use of its tokenization system ahead of the 2026 rollout of Kinexys Fund Flow, a platform designed to bring speed and transparency to private-market investing. The initiative aims to simplify how investors buy, sell, and track ownership of alternative assets such as private equity, hedge funds, and real estate.

JPMorgan Launches First Tokenized Private-Equity Fund

The tokenization process turns traditional fund ownership into a blockchain-based digital record, allowing investors and managers to see transactions and holdings in real time. For now, the fund is limited to wealthy clients of JPMorgan’s private bank, but the pilot sets the stage for broader use once the Kinexys platform is fully operational next year.

Anton Pil, head of global alternative investment solutions at JPMorgan Asset Management, said adoption is inevitable. “For the alternative investments industry, it’s just a matter of time that a blockchain-based solution is going to be adopted,” he said. “It’s more about simplifying the ecosystem of alternatives and making it, frankly, a little easier to access for most investors.”

Tokenization Aims to Simplify a Complex Market

Private funds are known for their opaque structures and complicated “capital call” system, where investors must deliver funds on short notice. Tokenization helps solve that problem by creating a shared ledger that tracks commitments, payments, and ownership continuously. This means fewer surprises and faster settlement, which is a shift that could make these markets more efficient and potentially open them to a wider pool of investors.

JPMorgan’s Kinexys system uses smart contracts to automate transfers between fund managers, administrators, and investors. It could also enable new functionality, such as using fund tokens as collateral for borrowing or bundling them into diversified portfolios of tokenized assets.

Many Banks Are Pushing Deeper into Blockchain

JPMorgan joins Goldman Sachs (GS) and BNY (BK) in pushing traditional finance deeper into blockchain territory. The timing follows the Genius Act, signed this summer by President Trump, which created a clearer regulatory framework for tokenized assets, including stablecoins and digital fund units.

The bank expects to expand tokenization to private credit, real estate, and hedge funds in the near future. If successful, this shift could reshape how investors access and trade the most exclusive corners of the market.

Is JPMorgan a Good Stock to Buy?

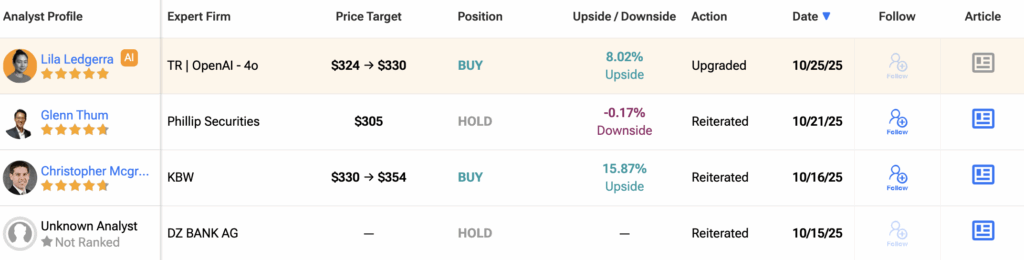

Analysts remain optimistic on JPMorgan Chase (JPM) following its latest blockchain announcement. According to 17 Wall Street analysts, the stock holds a “Moderate Buy” consensus rating, with 11 Buy recommendations and six Hold ratings over the past three months.

The average 12-month JPM price target sits at $338.77, implying a potential 10.9% upside from the current price.