JPMorgan says Bitcoin is now deeply undervalued compared with gold, calling the recent drop a potential buying opportunity as traders weigh Fed policy and ETF outflows.

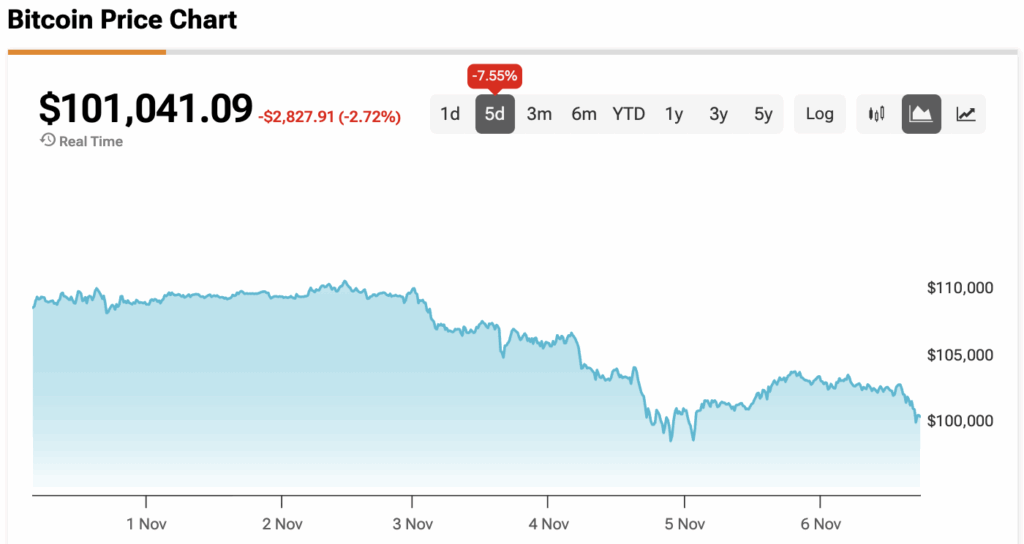

Bitcoin slipped below $102,000 on Thursday, joining U.S. stocks in another down day as new labor data and rising household debt stoked market anxiety. But according to JPMorgan (JPM), the latest pullback may have pushed BTC into undervalued territory, especially when compared to gold (CM:XAUUSD).

TipRanks data showed BTC down nearly 2%, falling in tandem with the S&P 500 (SPX) and Nasdaq 100 (NDX). The drop followed a report from Challenger, Gray & Christmas showing 153,000 job cuts in October, the highest for that month since 2003.

“October’s pace of job cutting was much higher than average,” said Andy Challenger, the firm’s chief revenue officer.

The weak jobs data hit just as investors digested concerns about rising U.S. household debt and the ongoing government shutdown. While some traders see these signals as a reason for the Federal Reserve to accelerate rate cuts, others warn the central bank may hold steady longer than markets expect.

According to CME Group’s FedWatch Tool, traders now assign roughly 69% odds of a 0.25% rate cut in December.

Crypto trading firm QCP Capital noted that risk assets remain vulnerable while ETF flows stay negative. U.S. spot Bitcoin ETFs have seen nearly $900 million in outflows over the past three days.

“The $100,000 psychological threshold is now the key line in the sand,” QCP wrote in its market note, adding that any stabilization in ETF flows could “quickly flip sentiment” if macro conditions hold steady.

Despite the turbulence, JPMorgan analysts turned optimistic, saying Bitcoin now looks undervalued compared to gold for the first time in nearly a year.

“Having been $36,000 too high compared [with] gold at the end of last year, Bitcoin is now around $68,000 too low,” wrote Nikolaos Panigirtzoglou, the bank’s lead strategist.

Just months ago, JPMorgan took the opposite view, saying Bitcoin was priced too high against gold. Analysts now suggest the relative discount could draw institutional buyers back if risk appetite improves.

Currently, $100,000 remains the critical support zone. A break below could trigger another leg toward the open CME futures gap near $92,000, while a recovery above $105,000 could restore confidence and invite dip buyers back in.

The renewed comparison with gold may also reignite the “digital gold” debate, especially if Bitcoin’s undervaluation persists while traditional safe havens stay firm.

As markets continue to juggle Fed expectations and macro headwinds, Bitcoin’s short-term outlook remains uncertain. But if JPMorgan’s view holds, the current levels could prove to be one of the better entry points of the year.

At the time of writing, Bitcoin is sitting at $101,041.09.