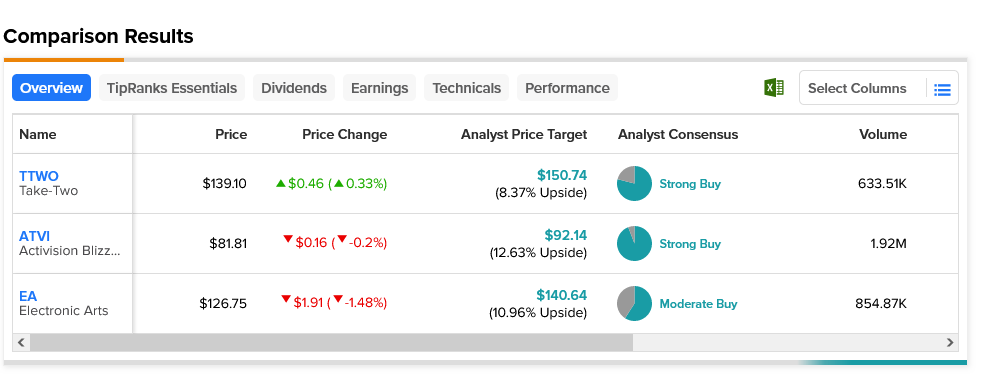

Yesterday, we took a closer look at video game stocks in the console market, with the summer showcases mostly winding down. Except for Nintendo’s (OTHEROTC:NTDOF), which won’t hit until early September. Today, however, the software side of things stepped in, and JPMorgan analysts took a look at three of the biggest software producers: Take-Two Interactive (NASDAQ:TTWO), Activision (NASDAQ:ATVI), and Electronic Arts (NASDAQ:EA). The look was enough to put Take-Two up fractionally, Activision down fractionally, and EA down somewhat in Tuesday afternoon’s trading.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

JPMorgan shook the landscape quite effectively, launching coverage on Take-Two and offering coverage on both Activision and EA as well. JPMorgan declared Take-Two a “Neutral” position while calling Activision “Overweight” and Electronic Arts “Underweight.” Activision came out ahead thanks to its “enticing risk/reward,” but both Electronic Arts and Take-Two weren’t likely to produce upside until sometime next year. Take-Two has solid intellectual property to work with, but since a release of “Grand Theft Auto VI” wasn’t likely before 2025, it’s a longer-term risk. Meanwhile, most of Electronic Arts’ upside was largely “…dependent on M&A” activity.

With the Microsoft (NASDAQ:MSFT) acquisition of Activision still stalled by government regulators, any benefit could be stalled, if not shut down altogether. However, since even Microsoft notes that Activision would operate separately after the merger anyway, the merger failing to go through shouldn’t be much of a problem for Activision. And there are large portions of Wall Street who consider Electronic Arts a good stock on which to be bullish.

Take-Two was the only one up today, but its Strong Buy analyst consensus also comes with the lowest upside potential. Thanks to an average price target of $150.74, it offers 8.37% upside potential. Meanwhile, Activision Blizzard may have been hit only slightly, but its 12.63% upside—thanks to its $92.14 average price target—makes this Strong Buy the winner among the aforementioned stocks.