JPMorgan analyst Brian Ossenbeck downgraded FedEx (FDX) stock to Hold from Buy and lowered the price target to $274 from $284. The 4-star analyst’s downgrade is based on his recent channel checks across a wide range of contacts in the less-than-truckload (LTL) industry, which suggested a lower multiple in his analysis for the Freight segment. The Freight business has been under pressure due to soft demand and overcapacity. FDX stock was down 0.45% as of writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Year-to-date, FedEx stock has declined about 13% due to the impact of tariffs and trade policies on demand, the removal of the de minimis exemption (a rule that allowed shipments valued under $800 to enter the country without duties or taxes), and intense competition.

JPMorgan Moves to the Sidelines on FDX Stock

Ossenbeck said that he is increasingly worried about FedEx’s full-year earnings per share (EPS) guidance being at risk, as it already accounts for a rebound in Freight fundamentals, which might not materialize. He added that the high cost of separating the Freight segment and the recent operational underperformance might impact the LTL multiple post-spin.

Separately, the 4-star analyst’s discussions across the parcel industry indicate that shippers are growing averse to higher rates while competitors continue to add capacity to the market.

While Ossenbeck’s target valuation for FDX stock still reflects a 1x premium to its historical average on a price-to-earnings (P/E) basis, he doesn’t expect the stock to re-rate higher until Federal Express can address some of its structural issues, such as profitability in Europe and negative mix in the U.S.

Is FedEx Stock a Buy or Sell?

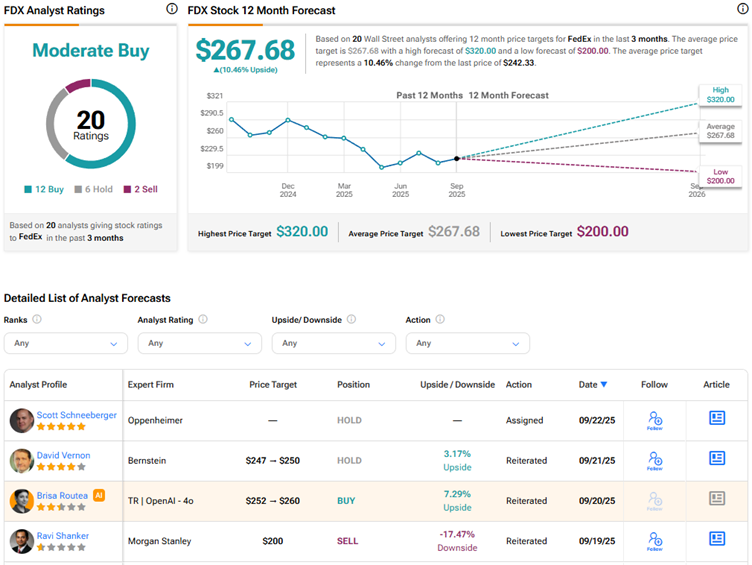

Due to soft global demand amid macro uncertainties and tariff woes, Wall Street has a Moderate Buy consensus rating on FedEx stock based on 12 Buys, six Holds, and two Sell recommendations (prior to JPMorgan’s downgrade). The average FDX stock price target of $267.68 indicates 10.5% upside potential from current levels.