U.S. bank JPMorgan Chase (JPM) has named credit card giant Visa (V) a top stock to own in 2026.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Visa recommendation comes as JPMorgan says that it expects 2026 to mark a reset for payments and financial technology (fintech) stocks after what it calls the sector’s worst year in more than a decade, excluding the 2020 Covid-19 pandemic.

In a note to clients, analysts at JPMorgan write that they are “happy to flush 2025,” arguing that slower growth and fears related to fintech returns on investment weighed heavily on share prices throughout this year. However, the bank expects better days ahead in 2026, writing that it favors companies such as Visa that have pricing power, strong margins, and solid momentum.

Avoid Turnarounds

In addition to Visa, JPMorgan likes fintech names such as Toast (TOST) and Block (XYZ) heading into 2026. The bank says that investors should “steer clear of turnarounds” such as Fiserv (FISV) and PayPal (PYPL) as they continue to be risky.

JPMorgan Chase said that Visa is its “top overall pick” in the fintech space heading into 2026, with analysts writing that the credit card and payments company “checks all the boxes” for a strong setup heading into the new year.

Is V Stock a Buy?

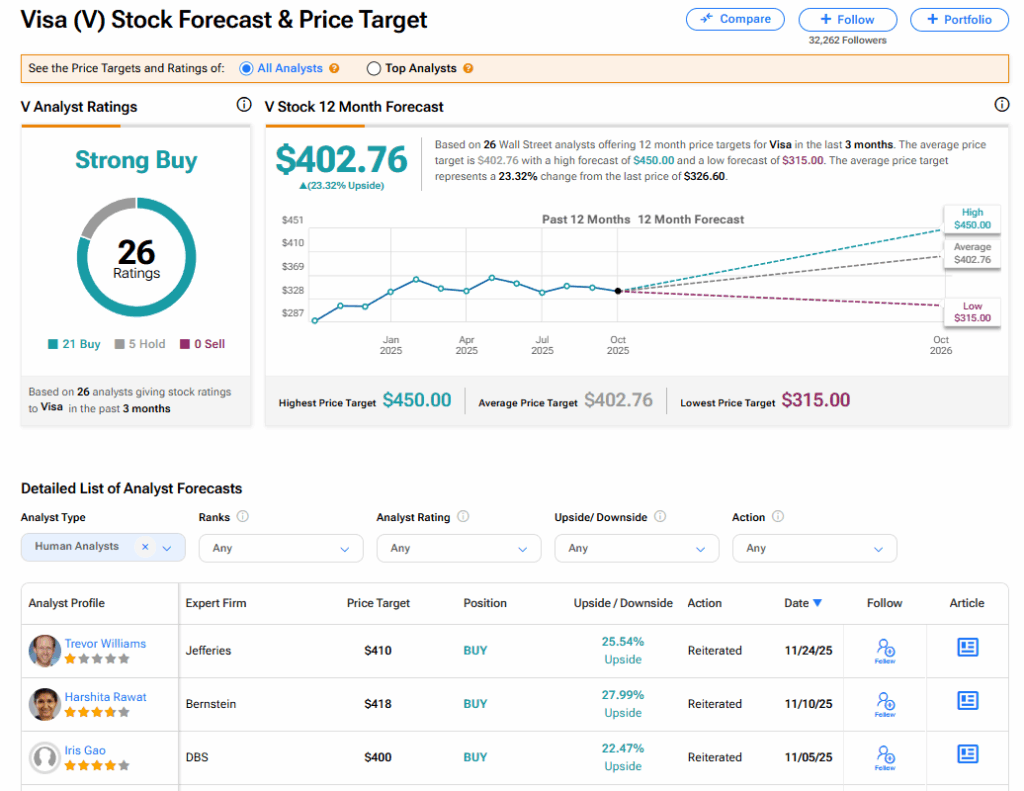

Visa stock has a consensus Strong Buy rating among 26 Wall Street analysts. That rating is based on 21 Buy and five Hold recommendations issued in the last three months. The average V price target of $402.76 implies 23.32% upside from current levels.