Blue-chip financial stock JPMorgan Chase (JPM) has proven itself to be a long-term winner, and the stock looks decidedly cheap despite its strong historical record.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

I’m bullish on shares of this $600 billion bank based on its history of generating strong returns for its holders over the long term and through a variety of market conditions, its inexpensive valuation, and its attractive dividend. In a turbulent economic environment, these characteristics make JPMorgan Chase the type of stock that investors can feel comfortable holding.

JPM Is a Long-Term Winner

JPMorgan can trace its history all the way back to the founding of its predecessor company “Bank of the Manhattan Company” in 1799. The firm then became JPMorgan & Co. in 1871. Now known as JPMorgan Chase after the merger of retail bank Chase Manhattan and investment bank JPMorgan in 2000, the company is the largest bank in the United States by assets, with over $4 trillion on its balance sheet. It is also the largest bank in the world by market cap. JPM is a juggernaut in the world of finance and its large size gives it significant scale advantages in areas like costs and technology.

The stock has generated excellent returns for its shareholders in modern times. JPM stock has generated a total return of more than 110% over the past five years, meaning that shareholders have more than doubled their money in that time. The stock has generated a stellar total return of more than 360% over the past decade.

Impressively, under the leadership of longtime CEO Jamie Dimon, JPMorgan has put up this excellent 10-year return during a period that threw numerous curve balls at banks and the stock market in general, ranging from the COVID-19 pandemic to 2023’s banking crisis. The fact that JPM posted a strong performance throughout is a testament to its strength.

JPM Is Well-Positioned for Lower Interest Rates

There is some consternation regarding how banking stocks will fare now that interest rates are declining, For JPM that will mean a decline in net interest income (NII). Net interest income is the spread between what a bank earns from its loans and the interest it pays depositors on their savings. NII is one of the principal ways that banks generate revenues, so it’s a key metric to monitor for bank stocks.

JPM itself is not immune to these concerns — the mega-cap stock fell more than 6% in a day during September when President & COO Daniel Pinto said that JPM’s 2025 NII will be lower than the $90 billion analysts are expecting, due to lower interest rates.

However, as the world’s largest bank and a diversified financial services giant, JPM is better equipped to deal with reduced net interest income than smaller banks. JPMorgan Chase is engaged in a wide array of business areas including investment banking, asset, wealth management, and others. Investment banking in particular could benefit from lower rates if Initial Public Offering (IPO) and M&A activity picks up. Lower rates could also be a catalyst for loan growth as businesses and individuals increase their willingness to take out loans at lower interest rates.

JPM Stock is Cheap

While JPM is a proven long-term winner, it’s still surprisingly cheap, creating an attractive entry point for investors. Shares trade at just 12x consensus 2024 earnings. For comparison, the broader market is nearly twice as expensive, trading at 22.8x earnings.

While the financial sector is typically one of the cheaper sectors of the market, the opportunity to buy this strong long-term performer at just over half the market multiple is attractive. This low valuation multiple gives investors a degree of downside protection and also leaves plenty of room for upside on the table over the long term.

Strong Dividend Stock Characteristics

In addition to this appealing valuation, JPM has also become an attractive dividend stock. Shares yield 2.4% on a forward basis, which may not jump off the page at you, but is nearly double the current yield of the S&P 500. Additionally, JPM is building its reputation for dividend consistency. The stock has grown its dividend payout for 10 consecutive years. With this commitment to dividend growth, investors buying the stock now are likely to enjoy even better dividends in the future.

Is JPM Stock a Buy, According to Analysts?

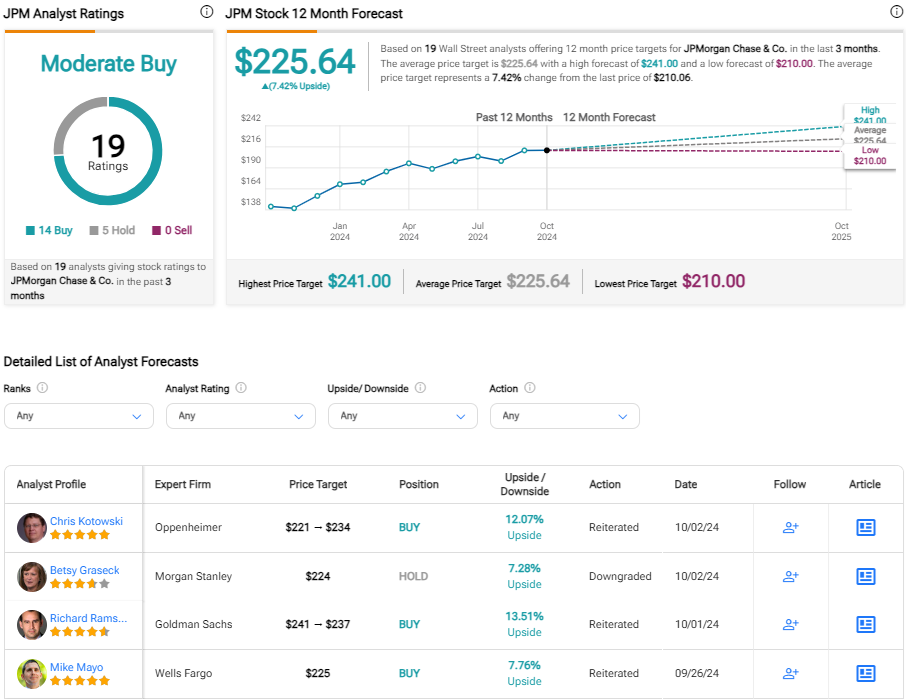

Turning to Wall Street, JPM earns a Moderate Buy consensus rating based on fourteen Buys, five Holds, and zero Sell ratings assigned in the past three months. The average JPM stock price target of $225.64 implies about 8% potential upside from current levels.

Investor Takeaway

Ultimately, I’m bullish on JPMorgan based on its long track record of success and its value characteristics. The stock’s inexpensive valuation provides investors some downside protection while leaving plenty of room for price appreciation on the table, and the 2.4% dividend yield is attractive.

JPM’s ability to push on and perform well through all market environments leads me to believe it will be able to weather future challenges. That makes this the type of stock investors can feel good about holding amidst an uncertain economic and macro environment.