JPMorgan Chase (JPM) is revising its diversity, equity, and inclusion (DEI) programs, rebranding them as diversity, opportunity, and inclusion (DOI), according to an internal memo. This change comes as DEI initiatives face rising scrutiny and criticism, particularly from the Trump administration.

The change from “equity” to “opportunity” is intended to clarify the bank’s focus on equal access rather than equal outcomes.

As part of other changes, some diversity programs previously managed by the DOI organization will now be overseen by other units like Human Resources and Corporate Responsibility. This aims to streamline processes and get more people involved. Also, JPMorgan plans to reduce the frequency of training on these topics, while focusing on more high-quality offerings.

Major Companies Scale Back DEI Policies

This shift is part of a growing trend among major U.S. and European companies. Many have scaled back or changed their DEI policies since President Trump signed an executive order in January. Conservative groups and activists have also put pressure on these companies to revise their DEI plans.

Similar to JPM, Citigroup (C) and Goldman Sachs (GS) have made similar moves. Citigroup dropped its rule for diverse candidate slates in job interviews and renamed its diversity team. Further, Goldman Sachs removed a board diversity rule and the diversity section in its yearly report.

Is JPM a Buy, Hold, or Sell?

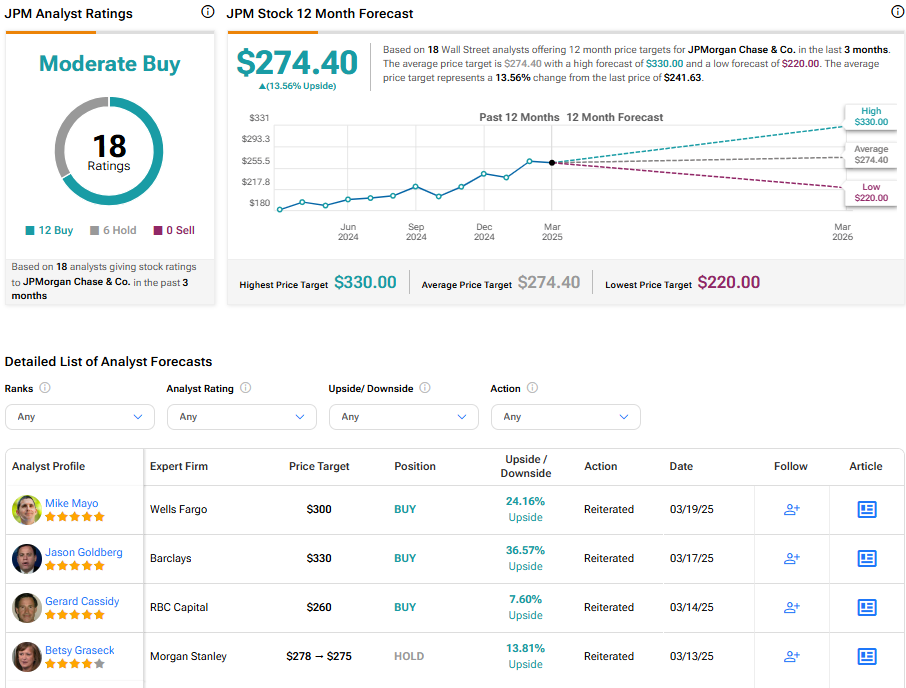

Turning to Wall Street, JPM stock has a Moderate Buy consensus rating based on 12 Buys and six Holds assigned in the last three months. At $274.40, the average JPMorgan Chase price target implies a 13.56% upside potential.