JPMorgan Chase (JPM), the world’s largest bank, has begun widespread layoffs a month after posting record annual profits.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

According to media reports, JPMorgan has cut about 1,000 employees so far in February and is planning to announce further workforce reductions in March, May, June, August, and September of this year. It isn’t clear exactly how many jobs the firm plans to cut this year but the New York-based bank had about 317,000 employees worldwide at the end of 2024.

The exact reason for the layoffs this year also isn’t immediately known. A spokesperson for JPMorgan Chase is quoted saying, “We regularly review our business needs and adjust our staffing accordingly—creating new roles where we see the need or reducing positions when appropriate.”

Strong Financial Results

The staff cutbacks come about a month after JPMorgan reported record annual profits. Management attributed the strong results to a robust stock market and resumption of deal making on Wall Street that includes mergers and acquisitions (M&A) and initial public offerings (IPOs). Revenue in JPMorgan’s investment banking unit rose 46% year-over-year in the fourth quarter of 2024 to $2.6 billion.

Strong financial results have also led to a big run in JPM stock. The bank’s shares have gained 62% in the last 12 months and are currently trading near an all-time high. The latest round of job cuts also come as JPMorgan Chase’s employees try to unionize at several of the bank’s locations in the U.S. JPMorgan is also returning all employees to the office five days a week starting in March.

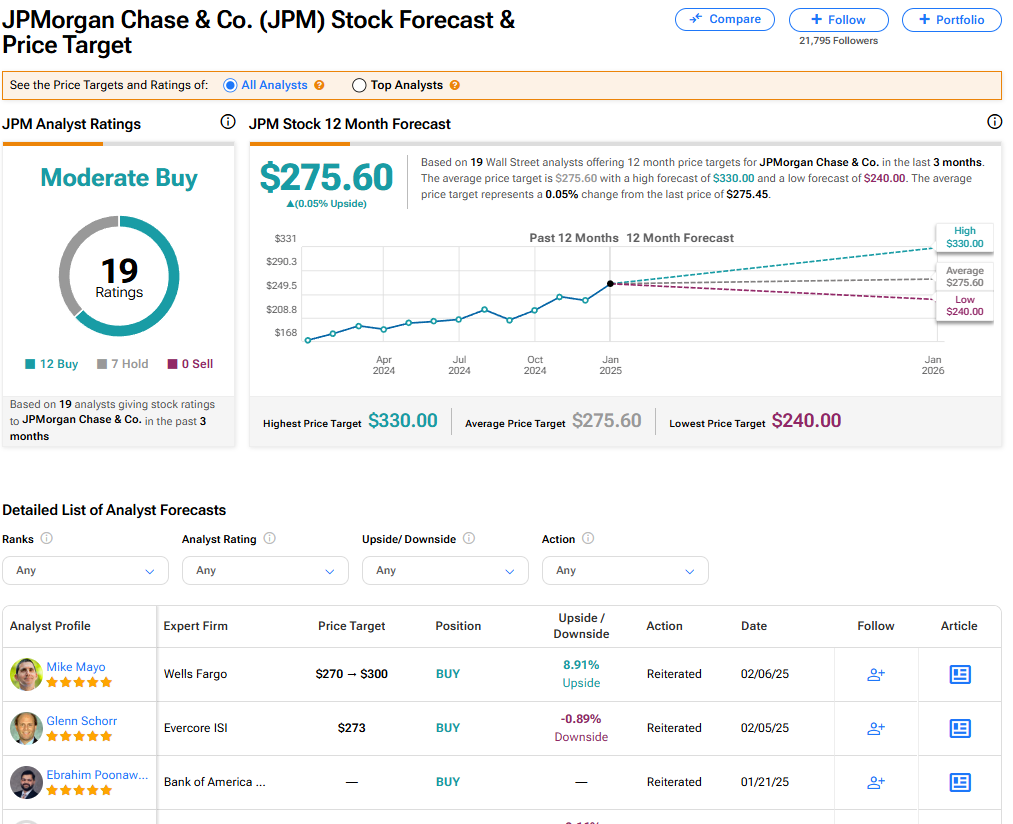

Is JPM Stock a Buy?

The stock of JPMorgan Chase has a consensus Moderate Buy rating among 19 Wall Street analysts. That rating is based on 12 Buy and seven Hold recommendations issued in the last three months. The average JPM price target of $275.60 implies 0.05% upside from current levels.