U.S. banking giant JPMorgan Chase (JPM) is set to release its fourth quarter 2025 financials on April 11. JPM stock has declined about 1% year-to-date, primarily due to slower loan growth, rising expenses from investments in technology, and increasing regulatory and political scrutiny on big banks. Wall Street analysts expect the company to report earnings per share of $4.63, representing a 4.3% increase year-over-year.

Meanwhile, revenues are expected to decrease by 34% from the year-ago quarter to $43.99 billion, according to data from the TipRanks Forecast page.

Analyst’s Views Ahead of JPM’s Q1 Earnings

Ahead of JPMorgan’s Q1earnings, Piper Sandler, R. Scott Siefers reduced his price target from $275 to $270 but maintained a Buy rating on the stock. He believes that JPMorgan is well-positioned to do well in the current uncertain market. The analyst points out JPMorgan’s large Markets business, which he believes will help counter weakness in the Investment Banking sector and support earnings.

Moreover, Siefers believes JPMorgan’s strong credit, liquidity, and capital position will help it keep its momentum and stay flexible in managing growth.

According to Main Street Data, JPM’s Commercial and Investment Bank segment brought in $17.6 billion in revenue in Q4. Despite weak consumer spending, it will be worth watching if this segment continues to show strength in the coming quarters.

Options Traders Anticipate a Minor Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 4.92% move in either direction.

What Is the Price Target for JPM?

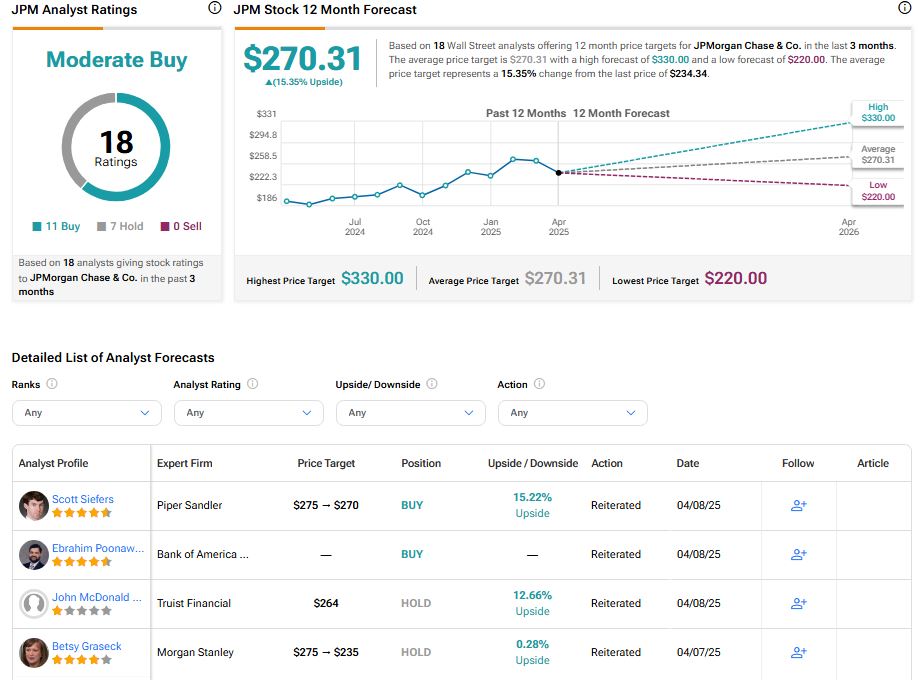

Turning to Wall Street, JPM stock has a Moderate Buy consensus rating based on 11 Buys and seven Holds assigned in the last three months. At $270.31, the average JPMorgan price target implies a 15.35% upside potential.