JPMorgan Chase (JPM) stock was on the move Tuesday after the financial company posted its Q3 2025 earnings report. This report began with diluted earnings per share of $5.07, which was better than Wall Street’s estimate of $4.85. It also represented a 16.02% increase compared to the $4.37 per share reported in the same period of the year prior.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

JPMorgan Chase reported revenue of $46.43 billion in Q3 2025, compared to analysts’ estimate of $45.47 billion. The company’s revenue climbed 8.9% year-over-year from $42.65 billion. This was fueled by a 9% increase in Banking & Wealth Management revenue, which was largely driven by higher net interest income on higher deposit margins.

JPMorgan Chase stock was down 0.43% in pre-market trading on Tuesday, following a 2.35% rally yesterday. The shares have also risen 31.2% year-to-date and 38.48% over the past 12 months.

JPMorgan Chase Guidance

JPMorgan Chase Chairman and CEO Jamie Dimon spoke about the latest earnings and future expectations. He said, “While there have been some signs of a softening, particularly in job growth, the U.S. economy generally remained resilient. However, there continues to be a heightened degree of uncertainty stemming from complex geopolitical conditions, tariffs and trade uncertainty, elevated asset prices and the risk of sticky inflation.”

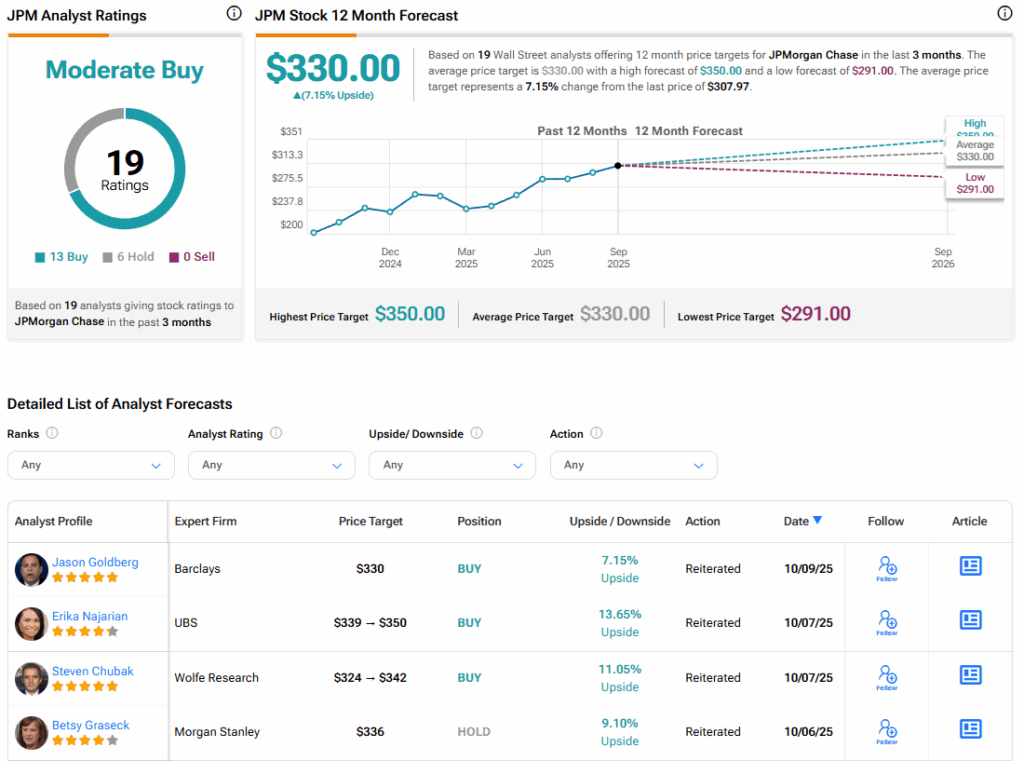

Is JPMorgan Chase Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for JPMorgan Chase is Moderate Buy, based on 13 Buy and five Hold ratings over the past three months. With that comes an average JPM stock price target of $330, representing a potential 7.15% upside for the shares. These ratings and price targets will likely change as analysts update their coverage after today’s earnings report.