With recession concerns circulating in the market, Johnson & Johnson (JNJ) stock could stabilize many portfolios. Since its founding in 1886, the healthcare giant has weathered numerous economic downturns. Even after spinning off its consumer health division in 2022, the company offers a diverse and non-cyclical range of products. Its stock remains attractive, boasting a 3.33% dividend yield and market outperformance since its 1985 IPO. For these reasons, I remain bullish on J&J, even amid economic uncertainty and market volatility.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Essential Medicines and Technologies Beef Up JNJ Portfolio

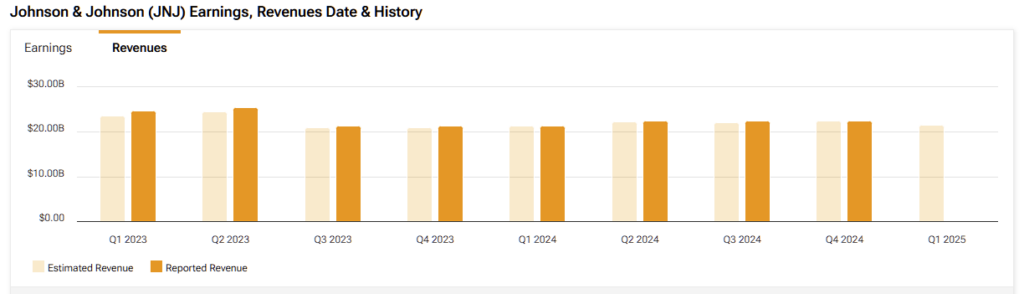

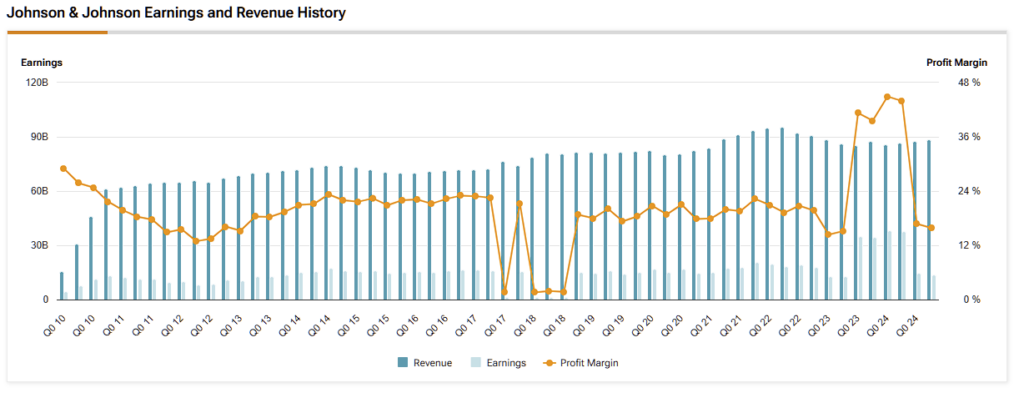

J&J has two primary businesses: Innovative Medicine and MedTech. Its Innovative Medicine portfolio includes blockbuster drugs like Stelara for plaque psoriasis and Invega for schizophrenia. In the full year 2024, this segment saw revenue grow 4.4% year-over-year to reach $56.96 billion. On the other hand, J&J’s MedTech portfolio includes electrophysiology and wound closure products. This, too, experienced growth in 2024, with revenues rising 4.8% year-over-year. Looking ahead to 2025, J&J expects operational sales growth of 3%.

JNJ Demonstrates Commercial Resilience

J&J’s modus operandi is slow and steady growth. While this doesn’t get growth investors riled up, it pays off when times get tough. During the 2008-2009 recession, J&J’s stock held steady even as the S&P 500 dropped nearly 50%.

Similarly, its two segments were tested during the COVID-19 pandemic. Its pharmaceutical portfolio was unaffected, growing 8.4% in 2020, offsetting a 10.5% decline in medical devices. While its MedTech segment is a consistent contributor, it is more sensitive to economic disruptions. Recall that many elective procedures were deferred during the pandemic. While this was predominantly a feature of lockdowns, a similar trend arises during economic downturns. J&J’s Innovative Medicines portfolio can see growth in spite of MedTech’s struggles because it features many life-saving drugs.

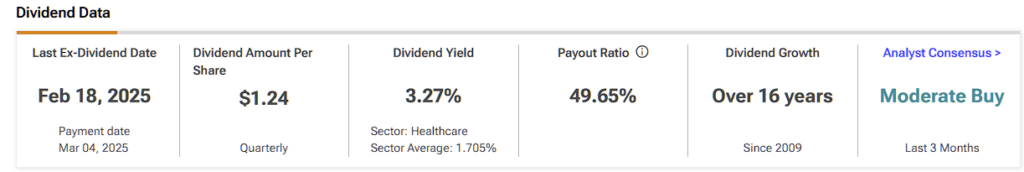

JNJ Demonstrates Dividend Excellence

J&J’s dividend track record is another major attraction for investors seeking stability. Remarkably, the company has increased its dividend for 62 consecutive years. J&J’s reliable cash flow generation across various economic cycles allows this. J&J’s financial strength is another key.

Currently, J&J is one of just two companies earning the highest possible credit rating (AAA) from Moody’s. Another is Microsoft (MSFT). However, J&J’s rating has a negative outlook, implying the company could soon see a downgrade—a potential eventuality related to litigation risks.

Litigation and Patent Risk Factors

J&J isn’t without its risks. Primarily, it still deals with the fallout from its past talc-based baby powder. Tens of thousands of claimants have alleged that J&J’s baby powder caused cancer. Although the evidence that talc-based powder causes ovarian cancer is described as “limited” and “mixed,” J&J has already dished out billions in settlement and legal fees. The company tried to slyly propose a $10 billion prepackaged bankruptcy plan to resolve the issue once and for all, but this was denied for a third time.

Ironically, J&J’s strong financial health impeded its bankruptcy contingency. So, it’s back to the tort system to litigate each case.

Moreover, like any pharma company, J&J is vulnerable to loss of exclusivity and subsequent competition from biosimilars and generic medicines. For instance, its blockbuster drug, Stelara, saw its revenues decline 4.6% year-over-year in 2024 due to increasing competition from biosimilars.

Notably, Stelara accounted for nearly 12% of J&J’s total revenues last year, which is why R&D investments are crucial to the long-term viability of pharma companies. Fortunately for J&J, its R&D engine produces blockbuster drugs on the ready. J&J’s Darzalex, originally approved in 2016 for multiple myeloma, has overtaken Stelara to become the company’s top-selling drug. In 2024, Darzalex generated $11.67 billion, representing 19.8% year-over-year growth.

Is JNJ a Buy or Sell Stock?

On Wall Street, JNJ has a Moderate Buy consensus rating based on seven Buy, eight Hold, and zero Sell ratings in the past three months. JNJ’s average price target of $169 implies an 11% upside potential over the next twelve months.

Just days ago, Tim Anderson, an analyst at Bank of America, reiterated a Hold rating on JNJ with a price target decreased from $171 to $159 per share. The analyst expressed caution, noting only modest revenue growth prospects, the potential impacts of tariffs on its MedTech segment, and a fairly valued stock.

JNJ Represents a Defensive Play for Uncertain Times

JNJ appears remarkably resilient to economic downturns and can provide investors with stability in a volatile market. JNJ’s stability is most exemplified by its beta of 0.30, which implies that for every 10% drop in the broader markets, JNJ drops by only 3%.

On the flip side, this implies a limited upside should the market turn things around. Additionally, the company is not without problems. Litigation outcomes and Stelara’s loss of exclusivity procure uncertainty. However, judging by its history, I’m confident that J&J can overcome these challenges and reward shareholders in the long term.