Healthcare giant Johnson & Johnson (JNJ) is scheduled to release its second quarter 2024 results on July 17, before the market opens. Wall Street analysts expect the company to report earnings of $2.71 per share on revenues of $22.33 billion. This compares unfavorably with the EPS of $2.80 and revenue of $25.55 billion reported in the year-ago quarter.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

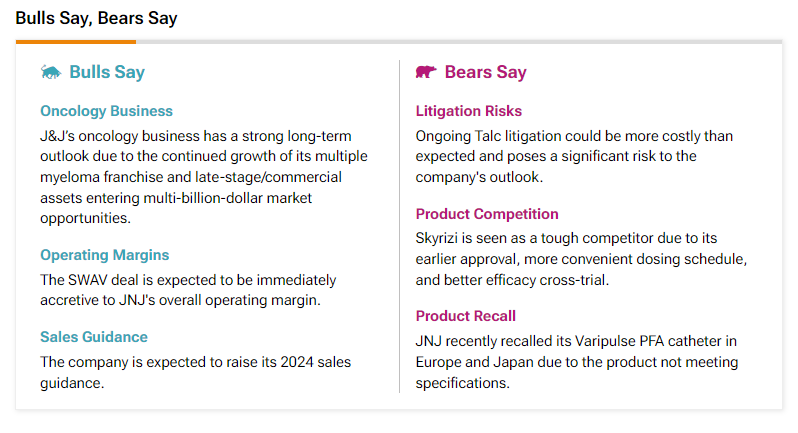

According to TipRanks’ Bulls Say, Bears Say tool, the company’s involvement in legal issues could be a reason for analysts’ conservative projections. Analysts bearish on JNJ stock believe that the ongoing talc litigation could be costly and pose a significant risk to JNJ’s outlook.

However, Johnson & Johnson has a positive earnings surprise history, consistently beating estimates since October 2020.

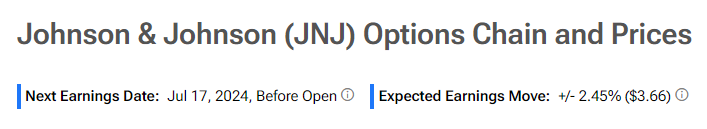

Options Traders Anticipate a Minor Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a 2.45% move in either direction.

Is JNJ Stock a Buy or Sell?

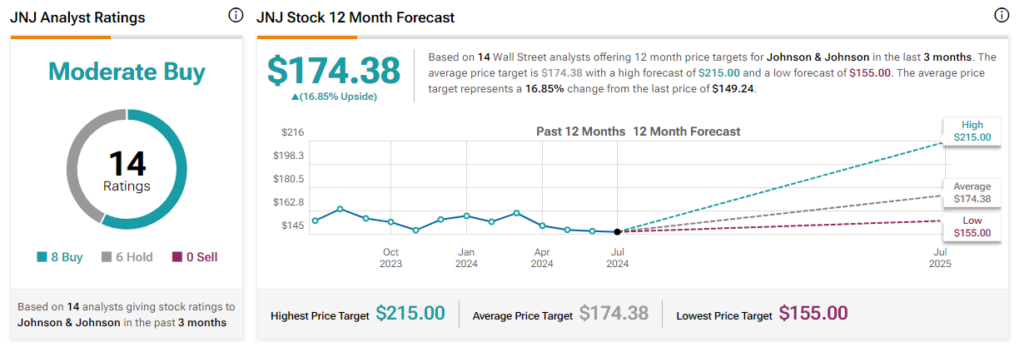

Turning to Wall Street, analysts have a Moderate Buy consensus rating on JNJ stock based on eight Buys and six Holds assigned in the past three months. After a 4.2% gain in its share price over the three months, the analysts’ average price target on JNJ stock of $174.38 per share implies a 16.85% upside potential.

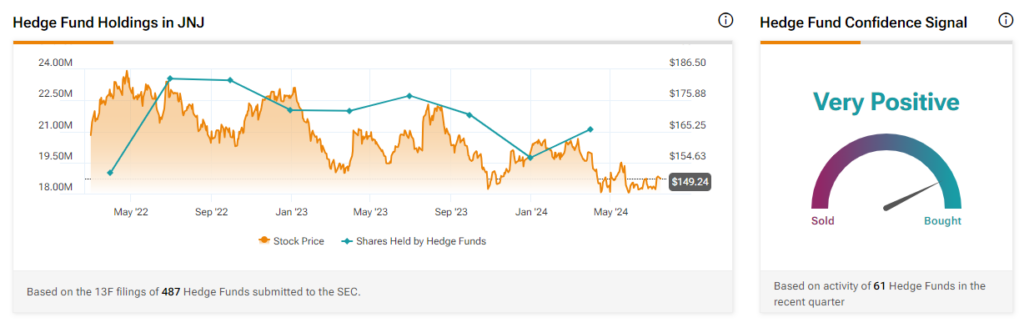

Meanwhile, hedge fund managers maintain a positive outlook on Johnson & Johnson. Currently, the Hedge Fund signal remains Very Positive for JNJ stock. As per TipRanks data, hedge funds bought 1.4 million shares of the company last quarter.