Shares of eVTOL (Electric Vertical Take-off and Landing) aircraft manufacturers—Archer Aviation (ACHR) and Joby Aviation (JOBY)—surged in today’s trading after Needham analyst Chris Pierce initiated coverage on the stocks with Buy ratings. Pierce pointed to their strong growth potential as the reason for his bullish stance.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Indeed, the overall eVTOL sector is heating up as investors focus on FAA approvals for air taxi operations in the U.S., as the FAA’s Innovate 2028 plan highlights the long-term importance of air taxis. Pierce predicts that the global air taxi market could hit $3 billion by 2029 due to demand for airport and metro transit trips. He expects supply issues to improve and more riders to choose eVTOLs for their time savings and competitive pricing.

In addition, Archer aims to start passenger flights in the UAE by late 2025, which could encourage the FAA to stick to its 2026 approval timeline. The analyst expects Archer to be EBITDA positive by 2028. At the same time, Joby is well-positioned to lead the market early, thanks to its partnership with Uber (UBER) and focus on software with its ElevateOS platform.

Which eVTOL Stock Is the Better Buy?

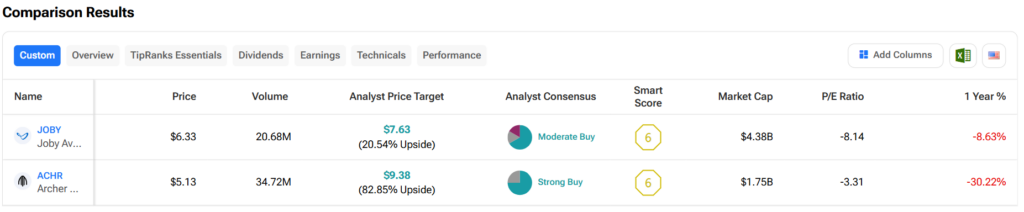

Turning to Wall Street, out of the two stocks mentioned above, analysts think that ACHR stock has more room to run than JOBY. In fact, ACHR’s price target of $9.38 per share implies almost 83% upside versus JOBY’s 20.5%.