The race for obesity-drug market share was one key highlight for Big Pharma in 2025. However, data indicate that Big Pharma’s 2025 rally is not solely the result of the weight-loss drug battle, as pharma indices outperformed the broader S&P 500 index in a year marked by artificial intelligence hype.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Last year, the NYSE Arca Pharmaceutical Index — which houses some of the largest pharma companies such as Eli Lilly (LLY), Johnson & Johnson (JNJ), Merck (MRK), and Pfizer (PFE) — rose about 21%, comfortably beating the S&P 500, which saw a 17.9% gain, and matching the tech-heavy Nasdaq 100 index, which grew 21%.

Johnson & Johnson Leads Stock Growth in 2025

Furthermore, broader pharmaceutical indices delivered larger gains, even as President Donald Trump’s drug pricing deals helped alleviate uncertainty about tariffs on the sector, thereby accelerating pharma stocks in the latter half of the year. Specifically, these indices rose:

- Dow Jones U.S. Pharmaceuticals Index — jumped about 31%

- S&P Pharmaceuticals Select Industry Index — rose about 30%

- Nasdaq U.S. Smart Pharmaceuticals Index — climbed about 24%

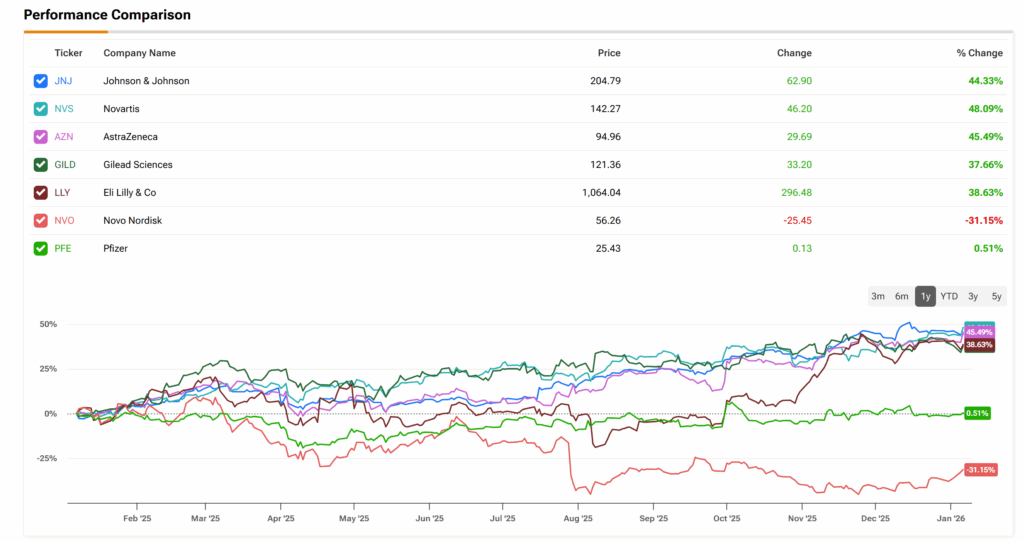

Narrowing it down, Johnson & Johnson (JNJ) led the Big Pharma group’s growth, with its stock adding 43% in 2025. This was followed by Novartis (NVS) and AstraZeneca (AZN), each with gains of more than 40%. This shows the growth story is beyond the pharma companies driving the obesity craze, although Eli Lilly (LLY) ended the year 39% stronger and joined the $1-trillion club in the same year.

Novo Nordisk Sees Early Rebound after 2025 Plunge

Conversely, Novo Nordisk (NVO) lost about half of its value last year, even as boardroom drama at the Danish pharmaceutical company ended in the installation of Lars Rebien Sørensen as chair. However, the firm’s shares have jumped about 13% since the start of 2026 as it has secured approval for and started selling its highly anticipated weight-loss pill in the U.S.

Meanwhile, for pharmaceutical companies such as Pfizer (PFE), which is facing the upcoming expiration of several major drugs, the story is different. PFE stock jumped a little over 7% in 2025.

As the pharma giant expects its COVID-19 product sales to continue to fall, it remains to be seen if its obesity-drug strategy through its $10 billion acquisition of Metsera and its oncology gamble will pay off in the long term.

What Are the Best Pharma Stocks to Buy in 2026?

Using TipRanks’ Stock Comparison tool, investors can identify which pharmaceutical stocks listed in this article are currently worth buying