Johnson & Johnson (JNJ) reported better-than-expected results in the fourth quarter. The biotechnology company’s adjusted earnings declined by 10.9% to $2.04 per share, slightly ahead of consensus estimates of $2.00 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

JNJ’s Cancer Drugs Drive its Revenues in Q4

Furthermore, the company’s revenues increased by 5.3% year-over-year to $22.5 billion in the fourth quarter, in line with consensus estimates. The growth in JNJ’s revenues was driven by a 19% rise in the sales of its cancer drug. This rise was led by Darzalex, its multiple myeloma treatment, which generated over $3 billion in sales, marking an increase of 20.9% year-over-year.

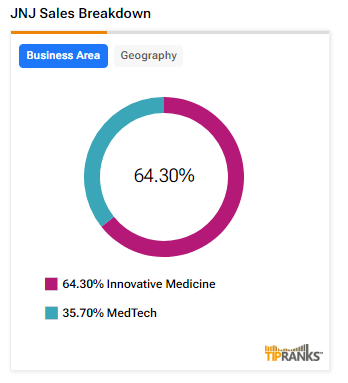

In addition, the company’s innovative medicine unit delivered fourth-quarter sales of $14.33 billion, up 4.4% from the prior year, while the medtech unit achieved $8.19 billion in revenue, a growth of 6.7% year-over-year. These results reflect robust demand across key product lines.

Notably, JNJ’s innovative medicine business comprised more than 60% of its total sales in Q4.

JNJ Issues FY25 Guidance

Looking ahead, the company expects adjusted earnings in the range of $10.5 to $10.70 per share in FY25 while revenues are likely to be between $89.2 and $90 billion. For reference, analysts were expecting the company to report earnings of $10.56 per share on revenues of $90.9 billion.

Is JNJ Stock a Buy or Sell?

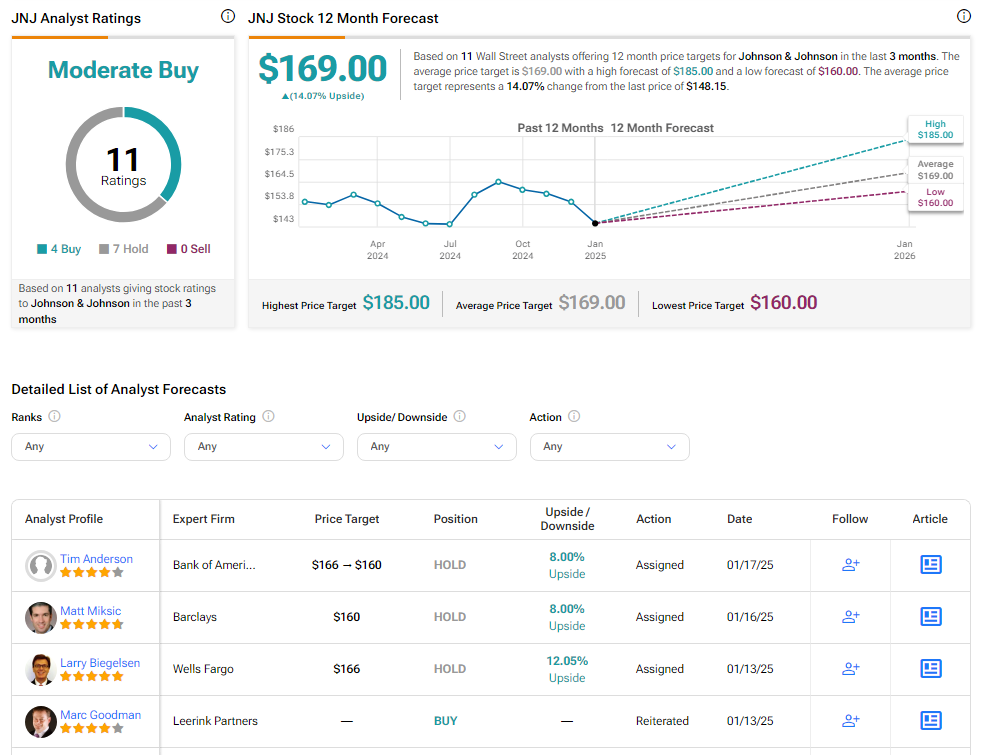

Analysts remain cautiously optimistic about JNJ stock, with a Moderate Buy consensus rating based on four Buys and seven Holds. Over the past year, JNJ has declined by more than 5%, and the average JNJ price target of $169 implies an upside potential of 14.1% from current levels. These analyst ratings are likely to change following JNJ’s results today.