Johnson & Johnson’s single-dose COVID-19 vaccine has been authorized for emergency use by the US Food and Drug Administration (FDA) for the treatment of adults. Shares rose 1.6% in after-hours trading on Feb. 26.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to the FDA, J&J’s (JNJ) single-dose vaccine offers protection against COVID-19 related hospitalization and death, across countries with different variants, beginning 28 days after administration. The US regulator’s decision was based on a Phase 3 study that demonstrated that the vaccine was 85% effective in preventing severe COVID-19 disease.

“This milestone follows a year of incredible work and unprecedented collaboration with health leaders around the world – all of whom shared a goal of bringing a single-shot vaccine to the public,” said J&J CEO Alex Gorsky.

Following the FDA decision, J&J has started shipping the vaccine to the US and targets the delivery of more than 20 million doses in March, and 100 million doses by the end of June. The company expects to produce 1 billion doses globally this year.

“We believe the Johnson & Johnson single-shot COVID-19 vaccine is a critical tool for fighting this global pandemic, particularly as it shows protection across countries with different variants,” said J&J’s Chief Scientific Officer Paul Stoffels. “A vaccine that protects against COVID-19, especially against the most dire outcomes of hospitalization and death, will help ease the burden on people and the strain on health systems worldwide.”

The US drug maker has also filed a European Conditional Marketing Authorisation Application to the European Medicines Agency as well as emergency use listing (EUL) with the World Health Organization for its COVID-19 vaccine. Additionally, J&J plans to submit a Biologics License Application (BLA) with the FDA later in 2021.

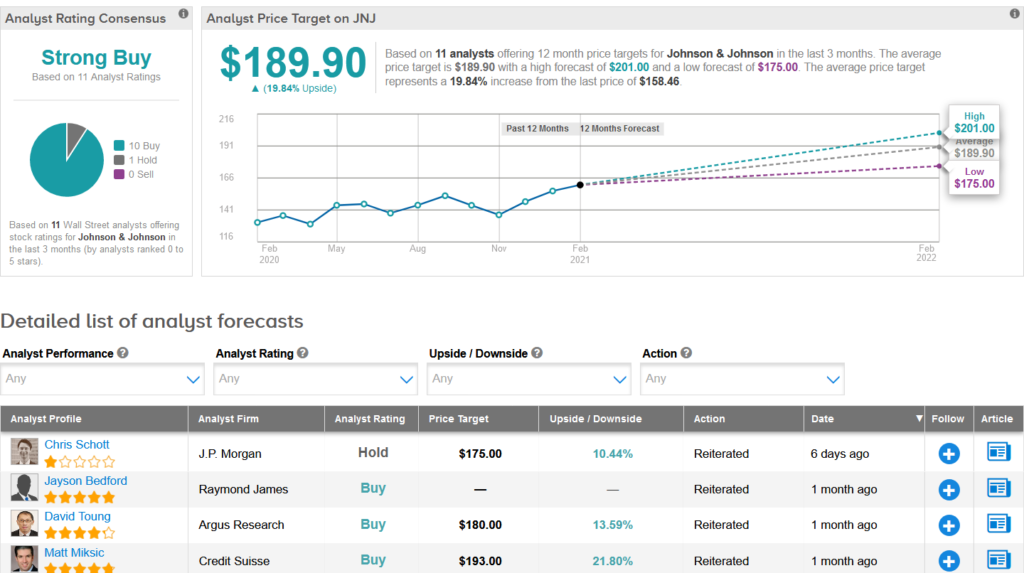

Shares of JNJ are up 10% over the past three months, and the stock scores a bullish Strong Buy Street consensus rating. That’s with 10 Buy ratings versus only 1 Hold rating. Meanwhile, the average analyst price target of $189.90 indicates almost 20% upside potential lies ahead.

Raymond James analyst Jayson Bedford on Jan. 26 lifted the stock’s price target to $183 from $158 and reiterated a Buy rating, citing improving growth potential.

“We view 2021 as financially de-risked. We believe J&J’s growth algorithm (4-5% revenue, 7-8% EPS growth) is intact, and we continue to believe the multiple can expand with consistent execution,” Bedford wrote in a note to investors. (See Johnson & Johnson stock analysis on TipRanks)

Related News:

Beyond Meat Posts Mixed 4Q Results; Street Says Hold

Moderna 4Q Revenues Jump To $571M On Back Of COVID-19 Vaccine; Shares Rise 4%

Tesla Confirms Fremont Factory Restart After Parts Supply Shortage – Report