Earlier today, JinkoSolar Holding (NYSE:JKS) offered up its earnings report, and the market did not take it well. The report had a few bright spots in it, but when it missed, it missed pretty big. Big enough, in fact, to send it down over 12% in Friday’s trading.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Immediately, JinkoSolar led off with a miss. JinkoSolar posted earnings of $0.85 per, which missed consensus estimates of $1.17 per share. However, JinkoSolar recovered with its revenue figures, postings $4.41 billion against the expected figures of $3.65 billion, representing a 71.6% year-over-year increase. JinkoSolar also noted that it was picking up speed toward mass production of its TOPCon solar cells, and expects its shipments to grow from here.

Despite the solid revenue figures and the cheerleading from top brass, JinkoSolar also lost ground in its gross margin figures. In 2021’s fourth quarter, JinkoSolar posted a 16.1% gross margin. In the third quarter of 2022, that dropped to 15.7%, and in the most recent quarter, it fell to 14.1%.

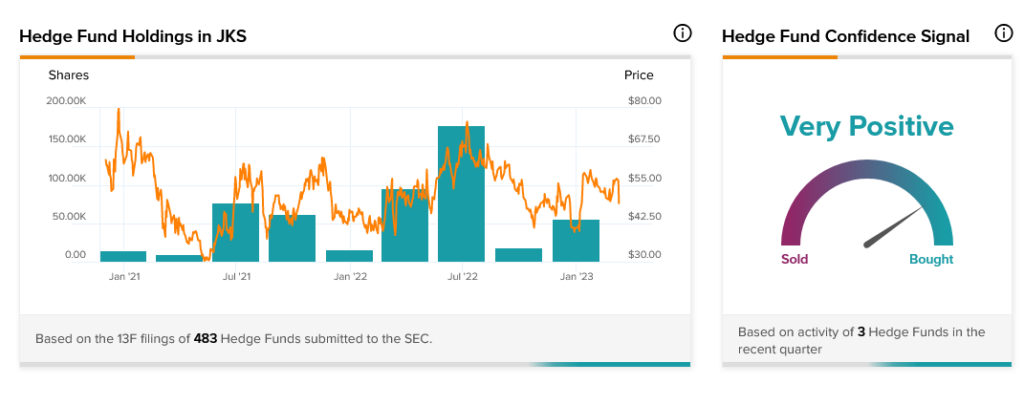

Despite a clear disappointment from investors, hedge fund sentiment appears to be Very Positive right now. Moreover, hedge funds hiked their collective holdings by 36,700 shares in the previous quarter.