JetBlue Airways (JBLU) experienced a historic one-day drop in its shares of over 25% due to disappointing financial projections. Despite announcing quarterly results that beat top-and-bottom-line expectations, the airline projected a year-on-year increase in unit costs, excluding fuel, of up to 7% this year. At the same time, it anticipates revenue may be slightly lower. To shore up the airline, management is implementing a cost-reduction strategy that includes cutting unprofitable routes, delaying new aircraft deliveries, and increasing revenue with higher-priced seats.

JetBlue’s CEO, Joanna Geraghty, remains optimistic about the company’s long-term profitability goals. The stock trades at an attractive valuation, though investors might want to hold off until the company can show positive financial momentum.

JBLU Faces Ongoing Challenges

JetBlue Airways provides air transportation services through various Airbus and Embraer planes. It recently faced a significant setback due to an engine manufacturing defect, which grounded planes this year. Further, employee compensation and aircraft maintenance expenses have increased faster than estimated.

To turn the tide, CEO Joanna Geraghty has initiated a program dubbed “JetForward” aimed at restoring profits. The strategy includes cutting off unprofitable routes, discontinuing flights to 15 cities, and curtailing services to Europe and South America. Despite these efforts, JetBlue anticipates costs per flown seat mile (excluding fuel) to rise 7% this year, surpassing analysts’ estimates.

While the company reported higher-than-expected winter holiday travel, unlike rivals United Airlines (UAL) and Delta (DAL), JetBlue does not foresee this stronger demand carrying into first-quarter results. This is primarily because its clientele mainly comprises leisure travelers who tend not to travel as much once the school year begins.

Lackluster Forward Guidance

JetBlue Airways reported results for the fourth quarter of 2024, with total revenue reaching $2.28 billion, surpassing analysts’ estimates by $20 million. However, the company experienced a net loss of $44 million, or -$0.13 per share.

The airline experienced a year-over-year decline of 5.1% in capacity and a 2.1% decrease in operating revenue for the same period. However, there were some positive aspects, including a 0.4% reduction in operating expenses per available seat mile (CASM). On the other hand, when excluding fuel and other specific categories, the CASM rose by 11.0% year-over-year. Non-GAAP earnings per share (EPS) of -$0.21 exceeded market expectations by $0.09.

JetBlue ended the quarter with $3.9 billion in unrestricted cash, cash equivalents, short-term investments, and long-term marketable securities.

Management has issued forward guidance, estimating available seat miles (ASMs) for 2025 to range from a decline of 5% to 2% in Q1 and is expected to remain roughly flat for the full year. Revenue per available seat mile (RASM) is projected to fluctuate between a decrease of 0.5% and an increase of 3.5% in Q1, with growth anticipated at 3% to 6% for the full year. Costs per available seat mile excluding fuel (CASM Ex-Fuel) could increase by 8% to 10% in Q1 and by 5% to 7% for the entire year. Fuel prices per gallon are estimated to be between $2.65 and $2.80. The company expects a positive operating margin of 0% to 1% for the year, with total capital expenditure approaching $1.4 billion.

A Cautious Approach Is Warranted

The stock has been on a downward trajectory, shedding over 58% in the last three years. After the recent drop, it trades in the lower half of its 52-week price range of $4.50 – $8.31. However, the sudden price decline has pushed its P/S ratio to 0.30x, making it a relative discount compared to peers in the industrial sector, where the average P/S ratio sits at 1.58x.

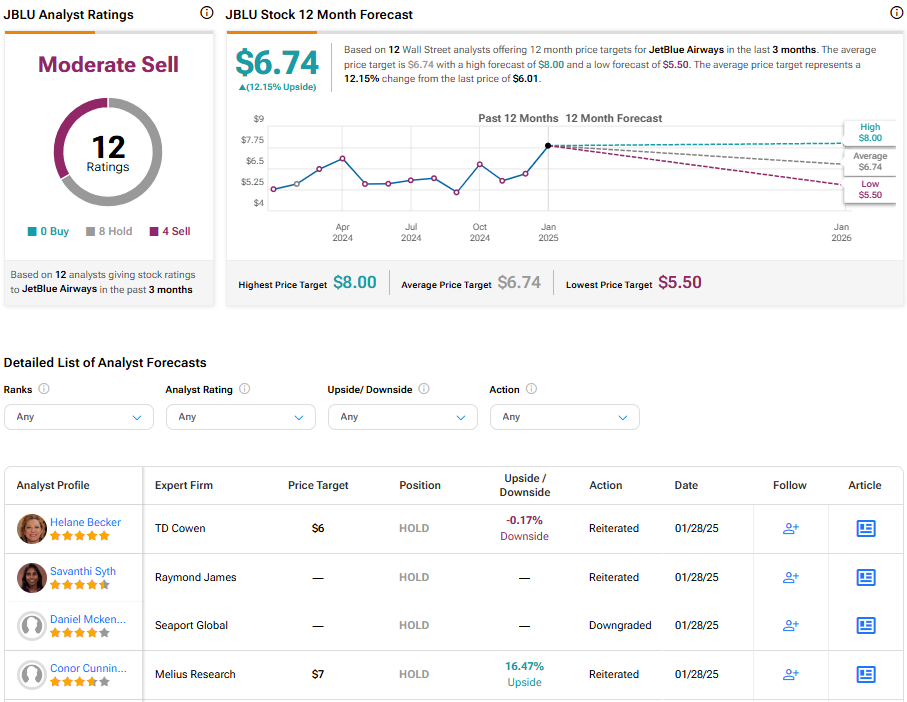

Analysts following the company have taken a cautious stance on JBLU stock. For instance, Seaport Research’s Daniel Mckenzie, a four-star analyst according to Tipranks’ ratings, downgraded the shares to Neutral from Buy without a price target following the recent earnings announcement, noting that Q1 revenue guidance fell short of expectations, pushing the company’s earnings recovery out.

JetBlue Airways is rated a Moderate Sell overall, based on the recent recommendations of 12 analysts. The average price target for JBLU stock is $6.74, representing a potential upside of 12.15% from current levels.

Bottom Line on JBLU

JetBlue Airways is navigating turbulent times, highlighted by a historic one-day drop in its stock. In response to these challenges, the company is implementing proactive measures that include a variety of cost-reduction strategies. Nonetheless, the road to recovery involves overcoming obstacles like engine manufacturing defects and soaring operating expenses. While the airline posted higher-than-expected earnings and wrapped up the quarter with adequate liquidity, it is bracing for potential challenges.

With its stock currently trading at an appealing valuation, JetBlue’s stock could present a significant opportunity for investors who have faith in its long-term potential. However, caution is recommended until there is clear evidence of positive financial momentum.