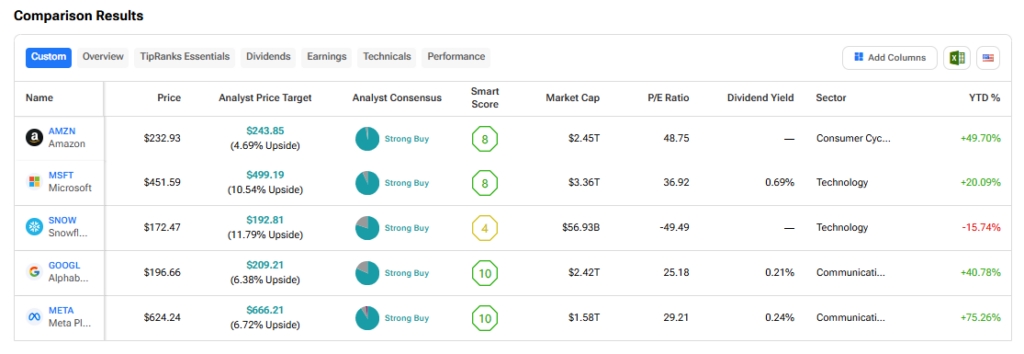

The investment firm Jefferies has identified Microsoft (MSFT), Meta Platforms (META), Amazon (AMZN), Snowflake (SNOW), and Alphabet’s (GOOGL) Google as potential winners in the artificial intelligence (AI) software market in 2025. These tech giants are well-positioned to benefit from the rapid advancements in AI technology and increasing adoption across several industries, such as healthcare, automotive, and retail.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Let’s dive into the key reasons behind Jefferies’ top five picks.

- Microsoft: Jefferies sees MSFT as a key beneficiary of generative AI due to its partnership with OpenAI. Also, analysts expect Microsoft’s Azure cloud platform and AI-driven tools like Copilot to grow in 2025, benefiting the company. Jefferies maintained a Buy rating on Microsoft stock with a $550 price target, implying a 21.8% upside potential from the current level.

- Meta Platforms: Meta’s massive user base of nearly 4 billion and over 200 million businesses offers a strong opportunity to add generative AI tools to its platforms. Also, new AI-powered ad tools positions Meta to benefit from AI growth. Analysts rate the stock a Buy with a $675 price target, suggesting a 1.3% upside.

- Amazon: AMZN’s strong presence in the cloud computing market positions it well to benefit from AI growth. The firm believes Amazon’s new efforts to incorporate AI tools into its offerings could enable it to catch up with its competitors. Also, the company’s focus on next-generation AI chips strengthens its position in the AI race. Jefferies raised AMZN’s price target to $275 (18.1% upside) from $235 while maintaining a Buy rating.

- Snowflake: Another key AI software beneficiary is Snowflake, according to Jefferies. The company is expected to reach an inflection point in 2025, with strong backlog growth and increasing AI contributions boosting top-line growth and margins. The firm raised the price target on Snowflake to $200 (16% upside) from $180 and retained a Buy rating.

- Google: Google’s strength in AI and ML technology puts it in a prime spot to benefit from rising generative AI demand. Also, the company’s AI-powered tools and services are expected to enhance its core products and drive user engagement. Jefferies has given GOOGL a Buy rating with a price target of $235, implying a 12.3% upside.

What Are the Best AI Stocks?

Among the above-mentioned stocks, all five stocks have a Strong Buy consensus rating. Looking ahead, analysts forecast the highest upside potential of 11.8% for SNOW stock, with MSFT following at 10.5%.