While electric vehicle (EV) demand has hit a few speed bumps of late, Chrysler-owner Stellantis (STLA) is staying the course over the future of the technology as the European auto market shows buyers switching.

Today the company announced it will invest €38 million ($41 million) in its Verrone plant in northern Italy to manufacture parts for electric motors for some of it latest smaller models. The plant will manufacture steel components for electric drive modules, with production expected to start at the end of 2027.

It comes after the Dodge and Jeep parent said on Friday it will manufacture Iveco’s new electric vans for the European market. The new all-electric vans will be based on the Stellantis Pro One mid-size and large van all-electric platforms and will be manufactured at its plants in Italy, Poland and France before delivering to Iveco. Stellantis and Iveco said they forecast commercialisation of the new models by mid-2026, based on a ten-year supply.

Luca Sra, President of the Truck Business Unit at Iveco Group, said, “We are excited to add two innovative and versatile battery electric vans to our Light Commercial Vehicle line-up, boosting our competitiveness in the van segment.”

Tricky EV Transition

European automakers are going through a difficult period amid the transition to EVs. Stellantis-owned Maserati recently canceled its plans to launch an electric version of its MC20 sports car, due to expected low demand.

EV sales slipped last year despite the car market as a whole remaining stable. A total of 1.99 million battery electric vehicles were sold in Europe last year, down 1.3% from 2023, according to data from the European Automobile Manufacturers Association (ACEA).

However, there have been some more encouraging signs in the first two months of 2025. In January, new battery-electric car sales grew by 34% to 124,341 units, capturing a 15% market share, while petrol car registrations declined 18.9%. Sales of hybrid-electric cars also increased by 18.4%. With 244,763 new cars registered in January, the market share for petrol dropped to 29.4%, down from 35.4% in the same month last year. In February 2024, battery-electric car sales grew by a modest 9% as sales of new hybrid-electric cars surged by 24.7%. Battery-electric cars held a market share of 12% (stable compared to February 2023), while hybrid-electric cars rose to nearly 29%.

Is STLA a Good Stock to Buy Now?

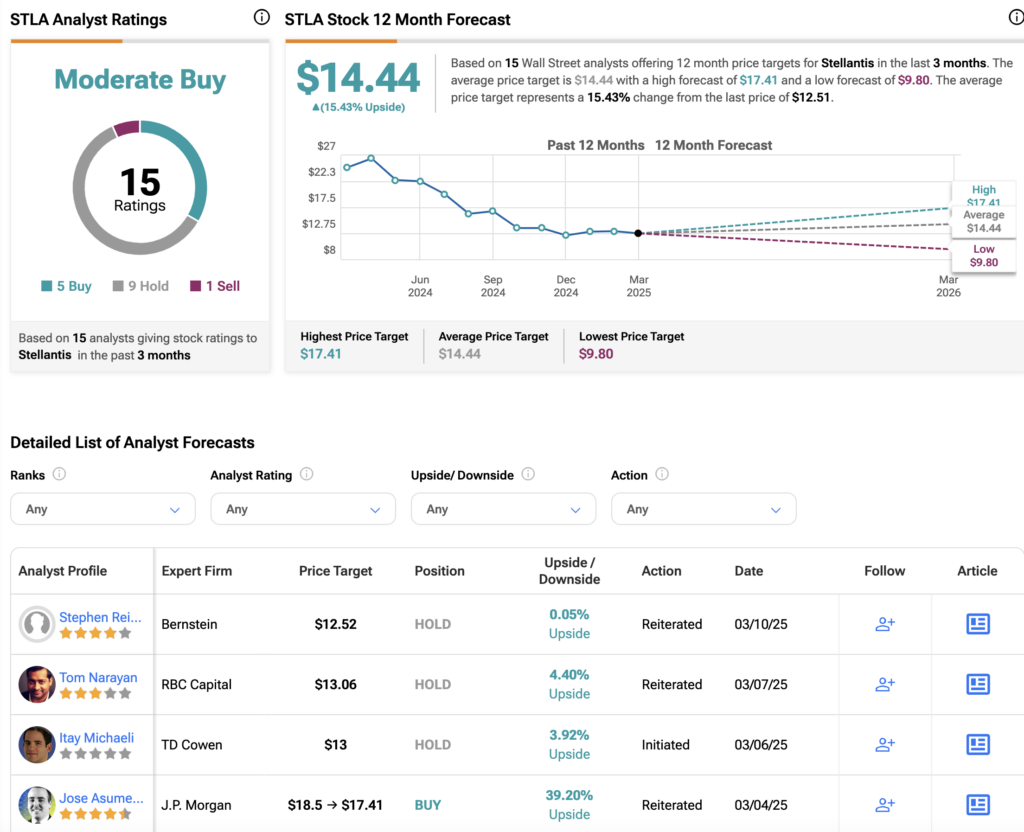

Turning to Wall Street, STLA stock has a Moderate Buy consensus rating based on five Buys, nine Holds, and one Sell assigned in the last three months. At $14.40 per share, the average Stellantis price target implies an upside potential of about 15%.

Questions or Comments about the article? Write to editor@tipranks.com