Chinese e-tailer JD.com (JD) is set to announce its Q2 2024 results on August 15. Wall Street analysts expect the company to report earnings of $0.87 per share for Q2, up 16% from $0.75 in the year-ago quarter. Meanwhile, analysts predict revenues of $40.61 billion, marginally higher than $39.7 billion in the year-ago quarter.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Interestingly, JD has an encouraging earnings surprise history. The company exceeded earnings estimates in all the previous nine quarters.

Insights from TipRanks’ Bulls & Bears Tool

According to TipRanks’ Bulls Say, Bears Say tool, bulls pointed to JD’s strong Q1 results, with both revenues and non-GAAP net income surpassing estimates. Also, analysts expect JD’s revenue growth to improve as the company’s Electronics & Home Appliances (E&HA) and Platform Business segments become more stable.

It’s important to highlight that both of these segments contribute to JD.com’s overall revenue and growth, with the platform business particularly focusing on expanding its marketplace and service offerings.

Meanwhile, bears are cautious about JD.com, noting that management has maintained conservative full-year guidance. They predict a slowdown in Q2 growth compared to the previous quarter, with year-over-year revenue growth becoming more challenging.

Options Traders Anticipate a 7.06% Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 7.06% move in either direction.

Is JD a Buy, Sell, or Hold?

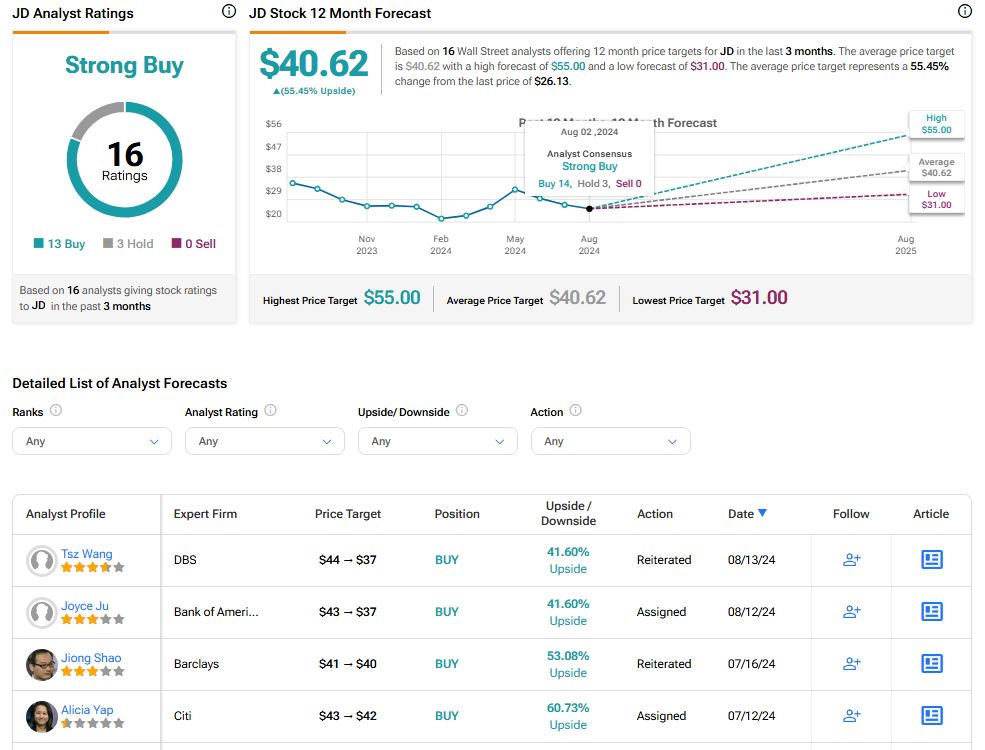

Turning to Wall Street, analysts have a Strong Buy consensus rating on JD stock based on 13 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 27% loss in its share price over the past year, the analysts’ average price target on JD stock of $40.62 implies an upside potential of 55.45%.