Shares of JetBlue Airways Corp. (JBLU) gained in pre-market trading after the airline major reported better-than-expected Q2 earnings. The company reported adjusted earnings of $0.08 per share, compared to earnings of $0.45 per share in the same period last year. Analysts were expecting JBLU to report a loss of $0.1 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

JetBlue generated operating revenues of $2.4 billion in the second quarter, a decline of 6.9% year-over-year, aligning with analysts’ estimates.

JetBlue’s JetForward Strategy

The company is implementing its JetForward strategy to drive the airline toward sustained profitability. As part of this strategy, JBLU is actively investing in its core geographies in New York, New England, Florida, and Puerto Rico.

JetBlue is targeting incremental Earnings Before Interest and Taxes (EBIT) in the range of $800 million to $900 million between 2025 and 2027 as part of its JetForward strategy.

However, the success of this strategy hinges on four pillars: reliable on-time service, refocusing its network on leisure travel routes, enhancing its offerings, and achieving $175 million in cost savings.

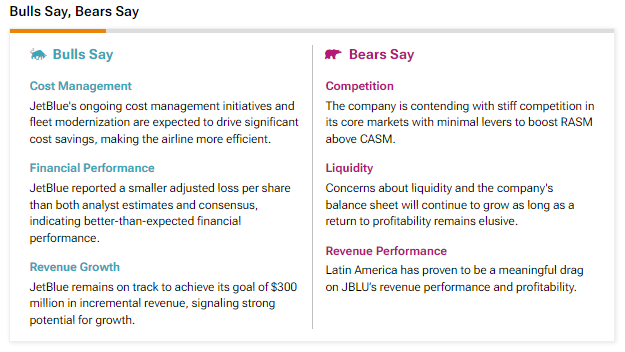

In fact, according to TipRanks “Bulls Say, Bears Say,” analysts bullish on JBLU stock have praised the company’s cost-saving initiatives and expect that its fleet modernization efforts will “drive significant cost savings, making the airline more efficient.”

JBLU’s Q3 and FY24 Outlook

JetBlue expects its revenues to decline from 5.5% to 1.5%, and from 6% to 4% in the third quarter and FY24, respectively. The company expects its operating costs, excluding fuel and other non-airline operating expenses, to increase in the range of 6% to 8%, and between 6.5% and 8.5% in Q3 and FY24, respectively.

JBLU’s President Marty St. George commented, “In the second half, we expect sequential year-over-year unit revenue momentum to bolster the top-line, supported by our $300 million of revenue initiatives and the continuing normalization of competitive capacity in our core geographies.”

Is JBLU a Buy or Sell?

Analysts remain bearish about JBLU stock, with a Moderate Sell consensus rating based on two Holds and one Sell. Over the past year, JBLU has declined by more than 20%, and the average JBLU price target of $5.17 implies a downside potential of 12.8% from current levels. These analyst ratings are likely to change following JBLU’s results today.