Jabil (NYSE:JBL) reported better-than-expected results for the third quarter of Fiscal 2024. Despite the Q3 beat, JBL stock fell over 11% in yesterday’s trading session as the company’s revenue and earnings declined year-over-year due to weakness in key end markets. Also, management commentary about near-term headwinds in the transportation and medical device sectors likely spooked investors.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

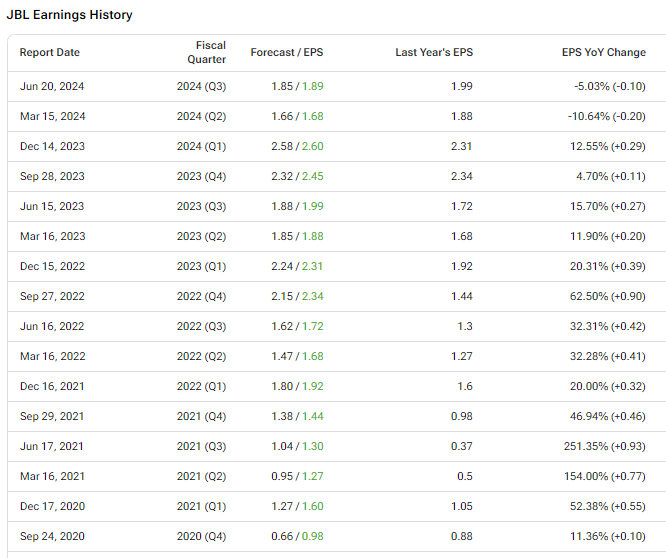

Jabil provides electronics design, production, and product management solutions. It should be noted that the company has an impressive earnings surprise history, as it has surpassed expectations in every quarter since September 2020 (For a thorough assessment of JBL stock, go to TipRanks’ Stock Analysis page).

JBL: Q3 Highlights

The company reported adjusted earnings of $1.89 per share, which surpassed the consensus estimate of $1.85. However, it compared unfavorably with EPS of $1.99 in the year-ago quarter. Moreover, Jabil’s revenue decreased 20.2% year-over-year to $6.77 billion but came above the consensus estimate of $6.53 billion.

In terms of segments, the Diversified Manufacturing Services (DMS) unit’s revenue plunged 23% year-over-year, primarily due to the divestiture of the company’s mobility business, completed in December 2023.

Furthermore, sales from the Electronics Manufacturing Services (EMS) segment declined by about 18% due to lower revenue in end markets like 5G, renewable energy, and digital print.

Fiscal Q4 and 2024 Outlook

For the fiscal fourth quarter, the company expects revenue to be in the range of $6.3 billion to $6.9 billion, along with adjusted earnings per share of $2.03 to $2.43.

For the full Fiscal 2024, JBL expects a slowdown in electric vehicles (EVs) and medical device businesses to be partially offset by strength in connected devices and our AI data center end markets. The company expects to report adjusted earnings of $8.40 per share from $28.5 billion of revenue.

Top Analyst Bullish Post JBL’s Q3 Report

Interestingly, five-star analyst Mark Delaney from Goldman Sachs maintained a Buy rating on the stock post-Q3 earnings release. The analyst has an average return of 19.51% and a success rate of 85% on JBL.

Delaney is optimistic about Jabil due to the company’s presence in high-growth markets, such as data centers, AI-related networking, medical, and industrial sectors.

Is JBL a Good Stock to Buy?

Currently, Jabil has a Strong Buy consensus rating based on five unanimous Buy recommendations. After a year-to-date decline of over 12%, the analysts’ average price target on JBL stock of $143.75 per share implies 28.59% upside potential.

Interestingly, investors considering Jabil stock could follow Stifel Nicolaus analyst Matthew Sheerin. He is the best analyst covering the stock (in a one-year timeframe). The five-star analyst boasts an average return of 20.6% per rating and a 92% success rate. Click on the image below to learn more.