Japan-based car manufacturer Honda Motor Co. (JP:7267) reported its Q1 results for FY25, with operating profit soaring 23% year-over-year to ¥484.7 billion. The company’s profits were mainly driven by a weaker yen and improved hybrid vehicle sales performance in the U.S. and Japan. For the full year, Honda maintained its operating profit forecast at ¥1.42 trillion.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Honda Motor is a Japanese conglomerate group and is a leading manufacturer of automobiles.

Insights from Honda’s Q1 Results

In the first quarter, Honda reported sales revenue of ¥5,404.8 billion, marking a growth of 16.9% over the same period last year. The top line was boosted by higher sales revenue in the Motorcycle and Automobile businesses and favourable foreign currency movements. Meanwhile, profit attributable to owners increased by 8.7% year-over-year to ¥394.6 billion.

On the flip side, the company’s performance in China remained weak with a 32% year-over-year decline in its Q1 sales. The company reduced its full-year outlook for China by 21% to 840,000 vehicles. Over the last few years, Honda has faced tough competition in China in terms of pricing and a slowdown in demand for its internal combustion engine vehicles.

Overall, Honda now expects to sell 3.90 million units in FY25, down from the previous estimate of 4.12 million units. However, the company maintained its projection for group Motorcycle sales at 19.80 million units for the fiscal year.

Additionally, Honda reiterated its forecast of a 9.7% decline in net profit and a 0.6% decrease in revenue for Fiscal 2025.

Is Honda Motor a Good Stock to Buy?

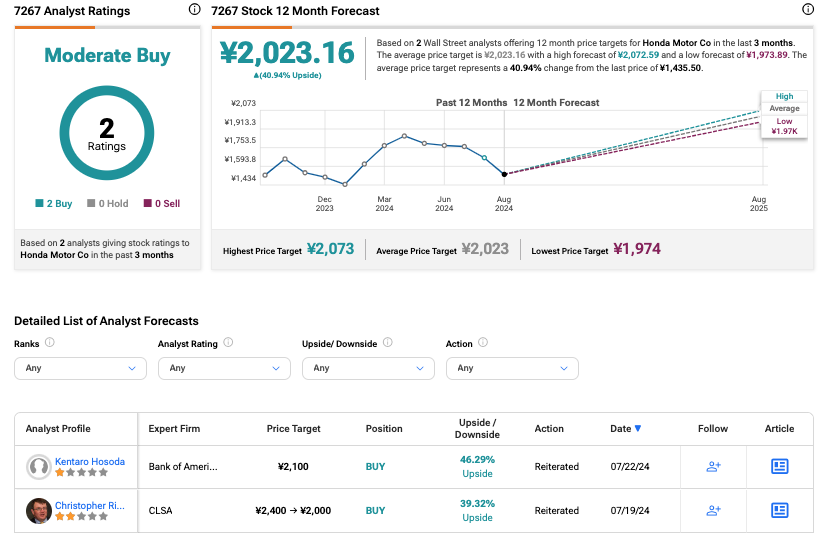

According to TipRanks consensus, 7267 stock has received a Moderate Buy rating based on two Buy recommendations. The Honda Motor share price target is ¥2,023.16, which is 41% above the current price level.