Berkshire Hathaway’s (BRK.B) massive stock portfolio is performing strongly thanks in large part to its holdings of several Japanese companies.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Of Berkshire’s $308 billion equity portfolio, a little more than $30 billion is invested in five Japanese trading houses. Those investments are giving a boost to Berkshire, with Japan’s benchmark Nikkei 225 index hovering near an all-time high.

Overall, Berkshire has done well with its Japanese investments that date back to 2019, with each of the five stakes it has more than doubling in value. Berkshire Hathaway CEO Warren Buffett has steadily increased his holding company’s stakes in the Japanese trading houses even as their share prices have risen.

Other Investments

The Japanese stocks include Itochu (ITOCY), Marubeni (MARUY), Mitsubishi (MSBHF), Mitsui (MITSY), and Sumitomo (SSUMF). Like Berkshire Hathaway, the Japanese trading houses are diversified conglomerates that are involved in international trade, energy, metals, food, and technology.

Beyond the Japanese investments, Berkshire’s portfolio has also gotten a boost from a rise in the share prices of several of its largest holdings, including Apple (AAPL), American Express (AXP), and Bank of America (BAC). In all, Berkshire Hathaway’s equity portfolio is up more than $25 billion this quarter.

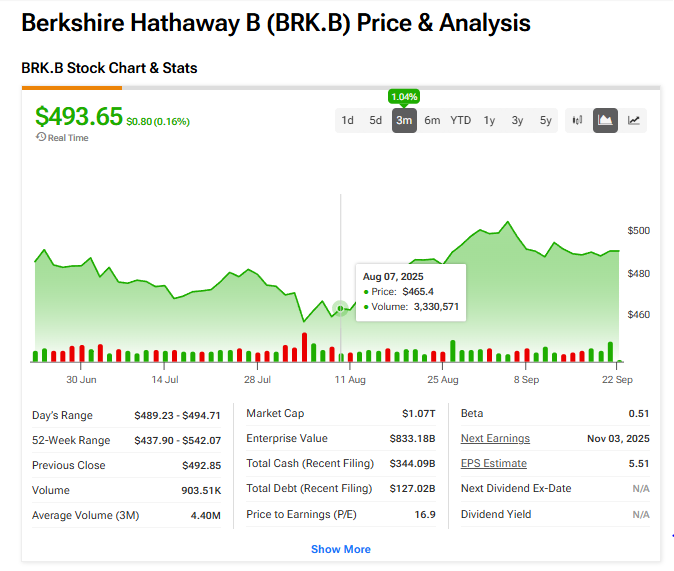

Yet BRK.B stock remains sluggish after Buffett announced in May that he plans to step down as CEO at year’s end. However, Buffett, age 95, will remain chairman of Berkshire’s board of directors, and analysts continue to upgrade BRK.B stock.

Is BRK.B Stock a Buy?

Only two analysts currently offer a rating and price target on Berkshire Hathaway’s more affordable class B stock. So instead, we’ll look at the stock’s three-month performance. As one can see in the chart below, shares of BRK.B have risen 1.04% in the last 12 weeks.